September Market Digest

Support: 157.6 -144.7 usc/kg

Resistance: 178.1 – 187.3 usc/kg

Support: 13,195 – 13,000 CNY/mT

Resistance: 15,105 – 15,785 CNY/mT

INE TSR20 (Active months)

Support: 10,220 – 9,960 CNY/mT

Resistance: 12,020 – 12,150 CNY/mT

TOCOM RSS3 (Active months)

Support: 193.7 – 182.1 JPY/kg

Resistance: 230.2 – 241.3 JPY/kg

Source: Wenhua Financial

All indices across different markets were range bound for most of September before breaking out to finish the month at or close to month’s high.

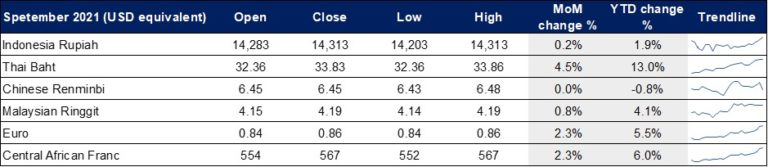

Overview of forex trends for September 2021

Source: Bloomberg

In general, USD appreciated against all listed currencies except for Chinese RMB in September as rising U.S. treasury yield, caused by Fed’s policy tightening outlook, sparked fund inflows back into USD.

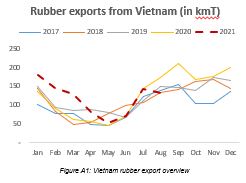

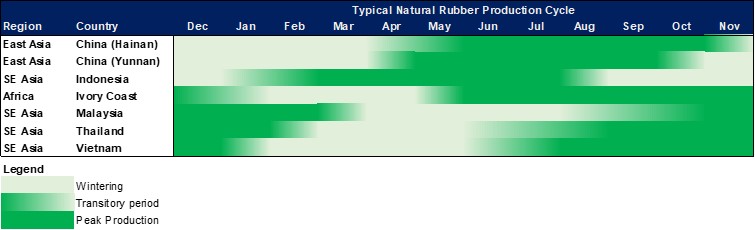

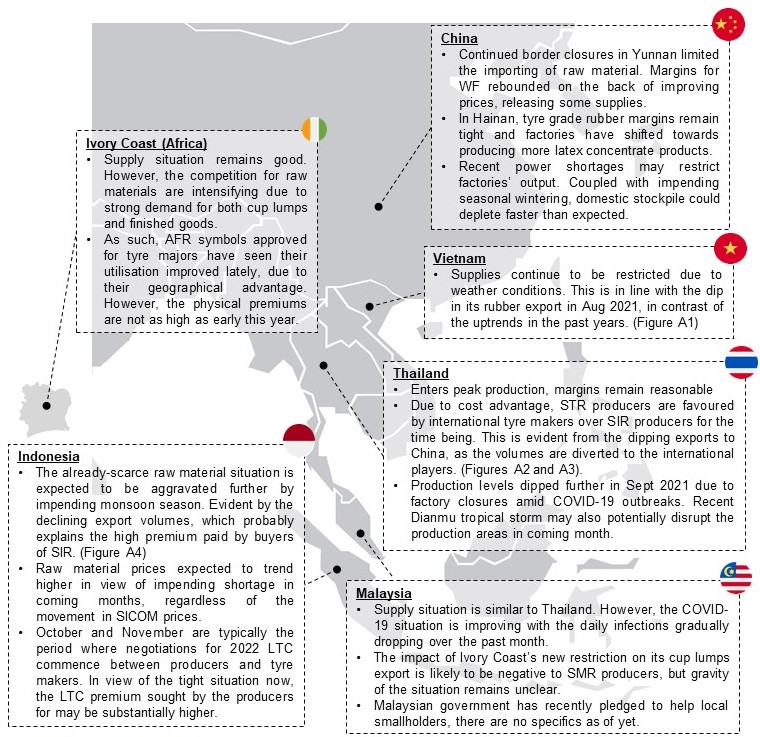

Overview of supply situation by key origins

Overview of demand situation

International

- Demand level continues to be healthy, despite the recent chip shortage situation experienced by automakers.

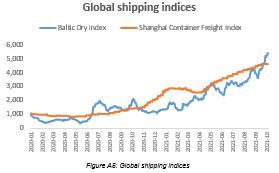

- It has also been observed the tyre makers have pivoted to ship the dry rubber to destinations through breakbulk shipments, rather than the conventional containers. This should alleviate the inventory shortage situation at year end.

- Freight rates remains high, but the rate of increase slowed during September. (Figure A5)

China

- The capacity utilisation of the PRC-based tyre factories is stable from previous months, in absence of any obvious stimulating factor. However, as aforementioned, the widespread power outage in key industrial and commercial provinces would be a near-term risk factor.

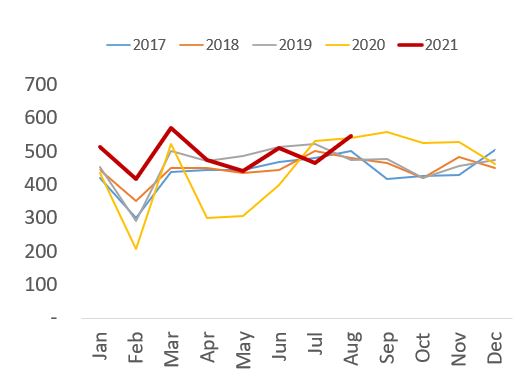

- Despite the stable operating rates in factories and the logistical congestion situation, China is exporting more tyres than ever, an indication of the strong automotive demand globally.

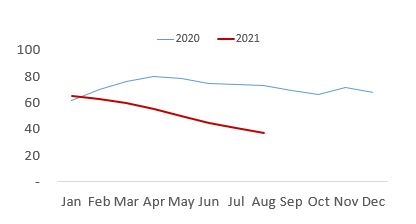

- Hence, China is drawing down from inventories to fulfil the surging demand, which caused overall stocks level to continue dropping. They are now running on much lower stock reserves – equivalent to one month of domestic consumption as of now, more than halved from year-ago period. It is also uncertain as to when China will restock its strategic reserve.

Tyre exports from China (in kmT)

NR stocks in China over average daily consumption (expressed in days)

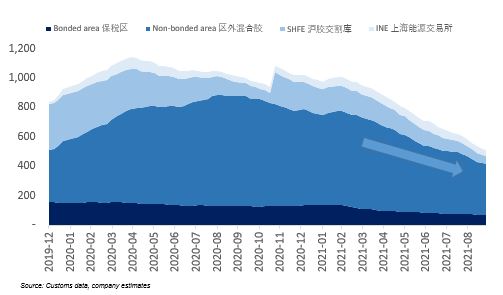

Estimated natural rubber stock level in kmT

Concluding thoughts

On the supply side, there are conflicting factors at play: Despite the origins entering seasonal peak production, but the heavy rain as a result of monsoon and typhoons may limit the potential upside. Raw material scarcity may remain a major theme for the supply in coming months.

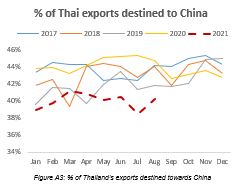

However, from a demand point of view, the international automakers and tyre makers have been procuring tyres and rubber rather aggressively. Meanwhile, the PRC domestic tyre makers’ utilisation rates appear to be weakening given the recent revelations. As the restocking has yet to take place, it may indicate that the rubber sources that has been historically destined towards China (most prominently being Thailand) may have been snapped up by the international tyre makers. Assuming that there are no new sources coming online, Chinese tyre makers may face supply pressure when they decide to re-stock.

Disclaimers

Appendix