Voluntary Business Updates (Q3 2021)

SINGAPORE, 11 November 2021 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”), provides voluntary operating and financial performance update for the third quarter ended 30 September 2021 (“Q3 2021”).

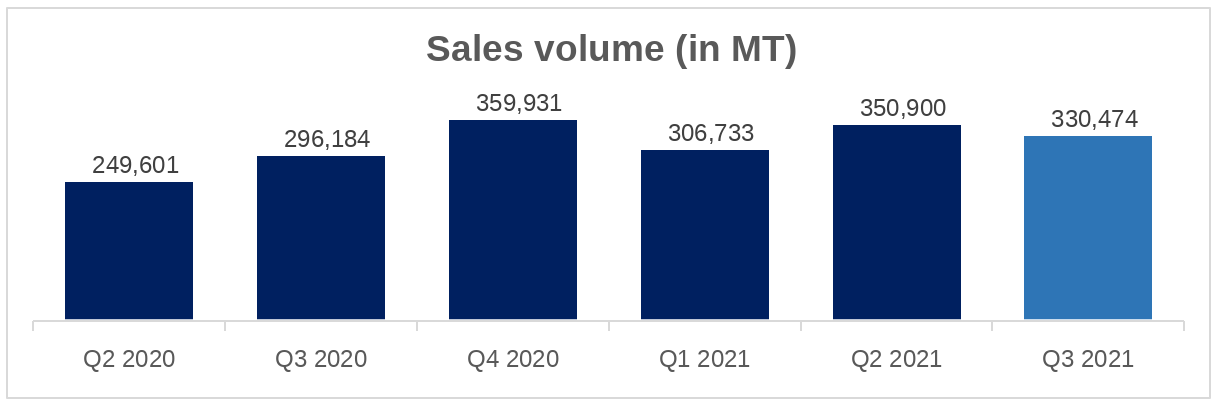

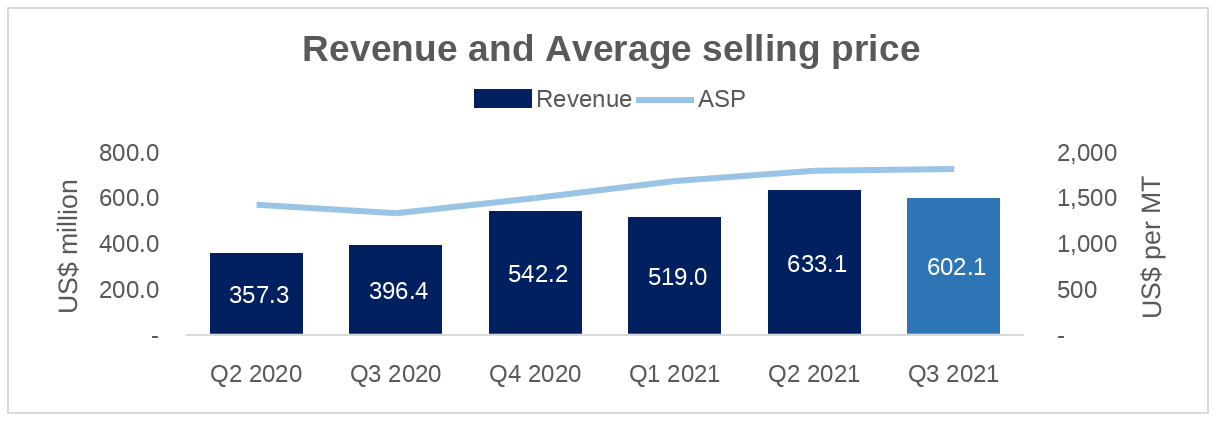

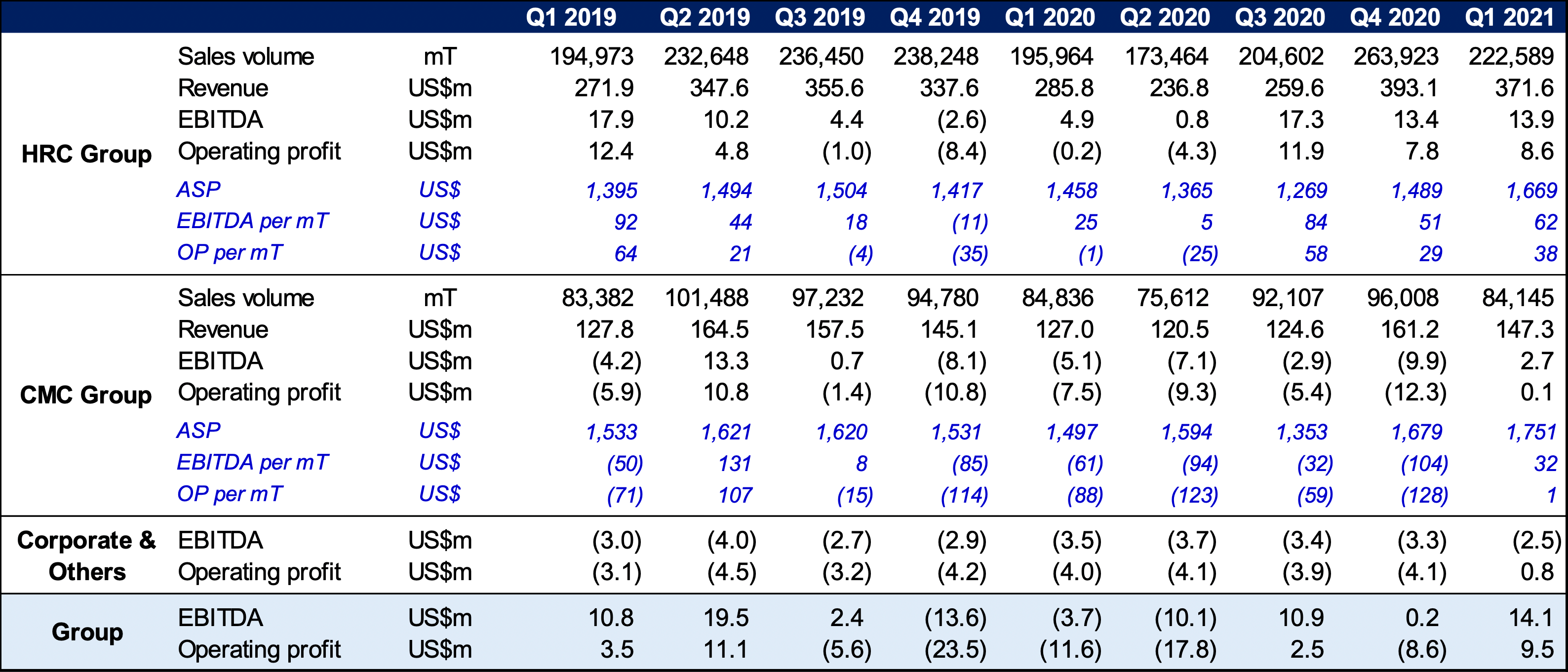

Capitalising on robust downstream demand, the Group has seen continuous improvement in its market position. Sales volume in Q3 2021 grew 11.6% compared to Q3 2020, and the Group’s revenue soared 51.9% on the back of higher sales volume and higher average selling price in Q3 2021.

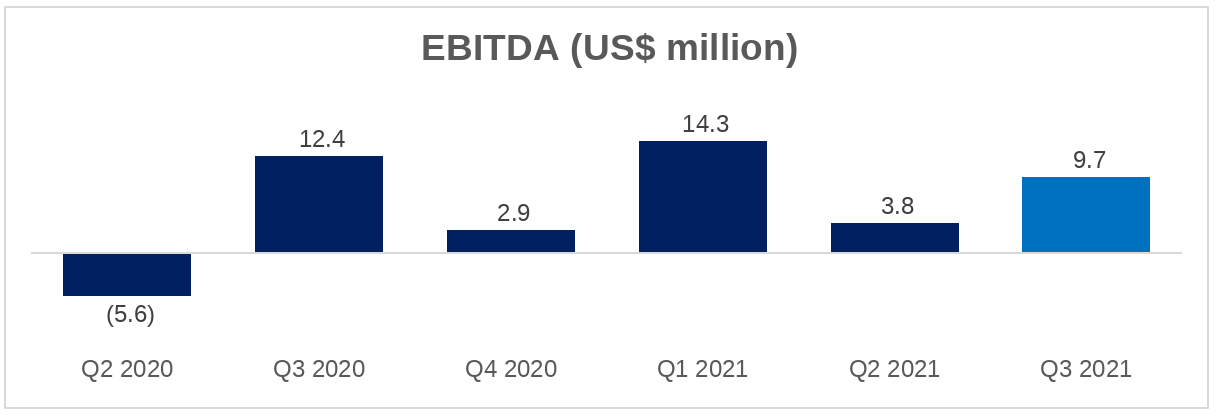

The Group recorded EBITDA of US$9.7million in Q3 2021, which brings its 9M 2021 EBITDA to US$27.8 million (9M 2020 EBITDA: US$3.1 million).

The Q3 2021 EBITDA was mainly contributed by Corrie MacColl International (CMCI), the Group’s industrial and non-tyre rubber distribution platform, attributed by the robust demand from customers in destination market. Our extensive distribution network allows us to stay close to our suppliers and our customers, and enables us to mobilise our global natural rubber resources effectively and efficiently to our customers, a key competitive advantage that accelerated business growth during the period when the industry was affected by logistics and supply chain issues.

The operation of the Group’s tyre grade rubber division, Halcyon Rubber Company (HRC) has improved from Q2 2021. The margins of the processing business were affected by new waves of COVID-19 cases in its key operating regions, which have disrupted the raw material supply and productivity. Extreme weather patterns in certain part of our operating areas have also caused tight supply and resulted in higher raw material prices. The tight supply is expected to continue in the near term amid increasing natural rubber demand.

CMC Plantations (CMCP), which houses the Group’s plantation assets, narrowed its operating losses during Q3 2021 as a result of effective cost management, margin improvement due to higher selling prices and better plantation yield following improvement in operational efficiency and the maturing of plantation.

Industry trends and outlook

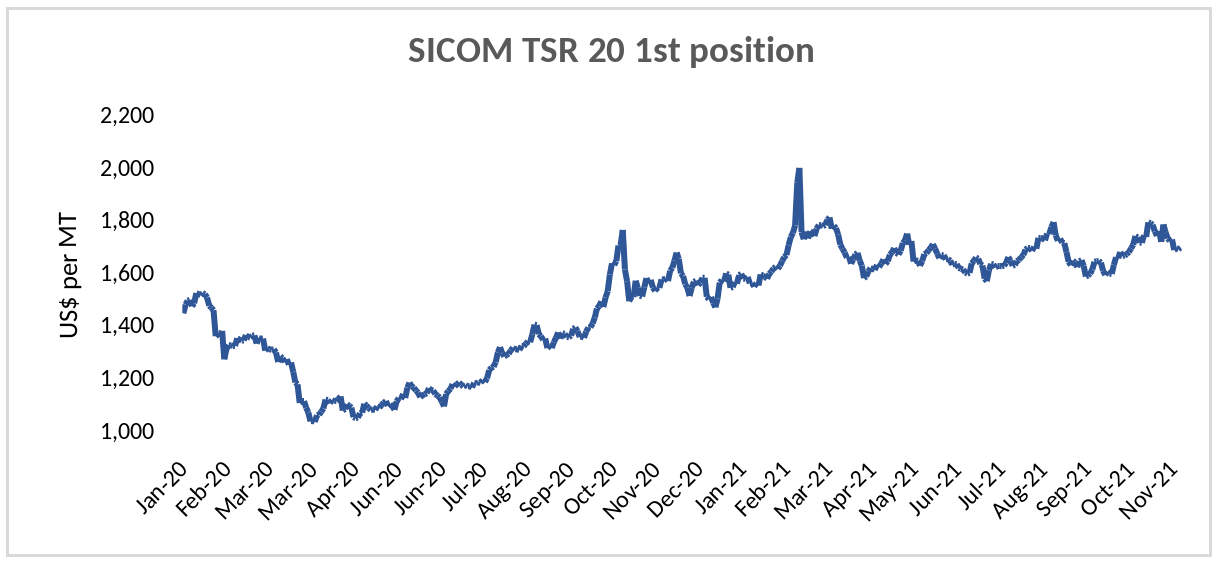

Source: Bloomberg as of 10 November 2021

Robust demand drove natural rubber prices up for a substantial part of the year to date. However, this was overshadowed by concerns on faster-than-expected tightening of monetary policy from central banks, as well as China’s regulatory crackdowns and electricity curbs in late September 2021. As a result, prices settled lower at US$1,680 per MT (indicated by SICOM TSR 20 1st position) at the end of Q3 2021.

Notwithstanding the recent trends, natural rubber supply continues to be tight, due to COVID-19 resurgence and extreme weather patterns in certain areas. Demand outlook remains positive in the near term and China is expected to restock its depleting natural rubber stockpile. The mismatch in supply and demand propelled natural rubber prices to an intraday high of around US$1,900 per MT on 21 October, the highest in nearly eight months, and the tight supply conditions are expected to continue to drive the natural rubber prices even higher.

Recent updated forecasts from the IMF, OECD, and World Bank suggested that global growth for remainder of 2021 and 2022 would remain sturdy, which supports demand growth for natural rubber. Supply is expected to remain tight. In the face of the impending supply shortage caused by drastic decline in new plantings over the years, it is becoming more crucial than ever for supply chain participants to recognise the importance of continuity and sustainability of rubber supply.

Cognisant of these trends, Halcyon Agri continues to focus on enhancing its sustainable business model while growing its market share profitably. The Group has recently aligned its Sustainable Natural Rubber Supply Chain Policy (SNRSCP) with the GPSNR Policy Framework. This is an important milestone for the Group in our continuous effort to partner with industry stakeholders to advance the sustainability agenda of the natural rubber supply chain.

CEO remarks

Commenting on the Group’s results and progress, Mr Li Xuetao (李雪涛), Chief Executive Officer of Halcyon Agri said, “We are pleased with the progress we have made to date across multiple fronts. Our business has registered considerable improvements as compared to previous period. We are cautiously optimistic with the outlook for the remainder of 2021 and we are confident on delivering a much better result in FY2021.”

Key Group financial performance summary

Q3 2021 sales volume increased 11.6% against last year. However, its 5.8% dip from previous quarter was mainly attributed to lower operating rate as a result of resurgence of COVID-19 cases in certain production areas.

Q3 2021 revenue of US$602.1 million represents a significant increase of 51.9% from Q3 2020, in line with its sales volume trends. Similarly, the revenue declined 4.8% from Q2 2021 – slower than the dip in sales volume, as it was offset by better prices. The uptrend in average selling price (ASP) is in line with buoyant natural rubber demand and prices.

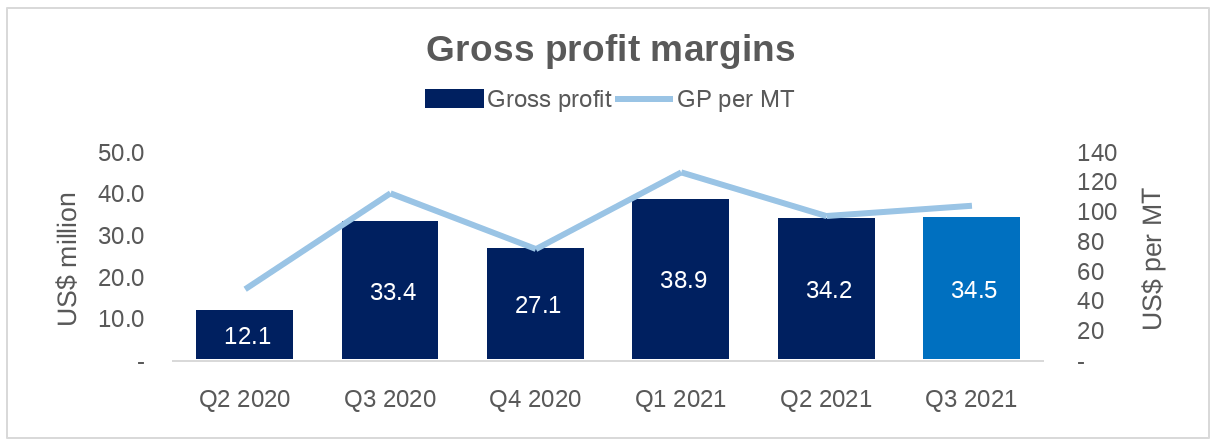

The Group recorded higher gross profits than Q3 2020 and Q2 2021. Gross profit per MT has continued to improve, owing to the Group’s agile supply chain strategies. EBITDA rose over two-fold quarter on quarter to US$9.7 million in Q3 2021.

Please refer to Appendix for a summary of operating statistics.

###

About Halcyon Agri

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

Email: [email protected]

Appendix – Selected operating statistics summary

Note: EBITDA relates to earnings before interests, tax, depreciation and amortisation which are operational items in nature. Therefore it excludes fair value changes from biological assets and investment properties, disposal gains and one-off non-operational expenses.

1https://www.halcyonagri.com/en/press-release/halcyon-agri-aligns-with-gpsnr-policy-framework/