Voluntary Business Updates (Q3 2020)

SINGAPORE, 26 November 2020 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) announces operating and financial information for the third quarter ended 30 September 2020 (“Q3 2020”).

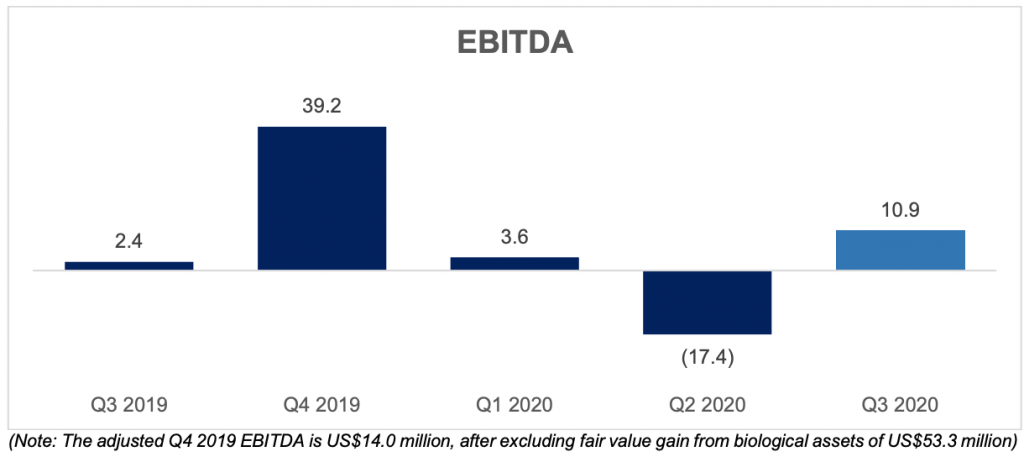

The Group has seen an overall improvement in its Q3 2020 results, reporting a 19% increase in sales volume from Q2 2020, and an 11% quarter-on-quarter increase in revenue. This was driven by improved global demand. An EBITDA of US$10.9 million is reported, a reversal from the Q2 2020 negative EBITDA of US$17.4 million, on the back of improved margins, arising from higher rubber prices as well as effective utilisation of factory capacity.

On 18 November 2020, Halcyon Agri has successfully completed the issuance of US$200 million 3.8% guaranteed subordinated perpetual securities, which marked an important milestone for the Group’s funding initiatives. Jeremy Loh, Chief Financial Officer of Halcyon Agri said, “The successful completion of the funding initiatives bolsters the Group’s net working capital and liquidity position. The guaranteed perpetual securities are accounted for as equity. As such, it strengthens the Group’s balance sheet and improves its leverage ratio. This will also facilitate future financing negotiations with our banking partners.”

Despite the present uncertain business conditions caused by the COVID-19 pandemic, the overall rubber market sentiment has gradually improved. Delivery and shipment activities which were affected by the lockdown in the previous quarters have returned to regular levels. Positive recovery of customer offtakes and stronger demand have allowed the Group to better utilise its factory capacity.

Moving forward, the Group will focus on the following key initiatives:

- Building operational resilience and delivering customer value. Leveraging on our global reach and diversified origins, we are well positioned to seize the opportunities to strengthen our market presence and meaningfully increase our factory utilisation. The Group’s seamless connectivity across its operating base facilitates effective capturing of the surge in customers’ current and future demand for spot cargoes, which was scaled back in H1 2020 due to lockdown disruptions.

- Protecting our business and people amid COVID-19. Halcyon Agri’s global operations continued to operate at full scale, with health and safety of our employees as our top priority. Strict compliance with SOPs and safe distancing measures continued to be in place across our operations, including offices, factories and the plantations.

- Expanding Halcyon Agri’s lead in the global sustainability arena. Our commitment to uphold the highest standards for sustainability and to be a sustainability leader in natural rubber industry have borne fruit, as evidenced by the recognition from respected third-party organisations. Halcyon Agri has been awarded an EcoVadis Gold Medal in recognition of its responsible conduct in the environment, labour practices, ethics and sustainable procurement. Besides, the Company’s Malaysian subsidiary, JFL Holdings Sdn Bhd, which is the concession holder of the Group’s plantation located in Kelantan, has received the Malaysian Sustainable Palm Oil (MSPO) certification, a testament to the Group’s industry leading plantation practices.

- Deepening collaboration with strategic partners. On 9 November 2020, Corrie MacColl Holdings, Inc, the Company’s wholly-owned subsidiary has invested in preferred stocks in Continental American Corporation (“CAC”). CAC owns Pioneer Balloon, which is one of the world’s largest balloon supplier. This transaction is part of the strategic initiatives to foster collaboration with its key partners, and to support CAC’s new venture into the production of Page 2 of 4 latex gloves. This transaction paves the way for further similar investments in future, and potential diversification of the Group’s business.

Key Q3 2020 performance summary

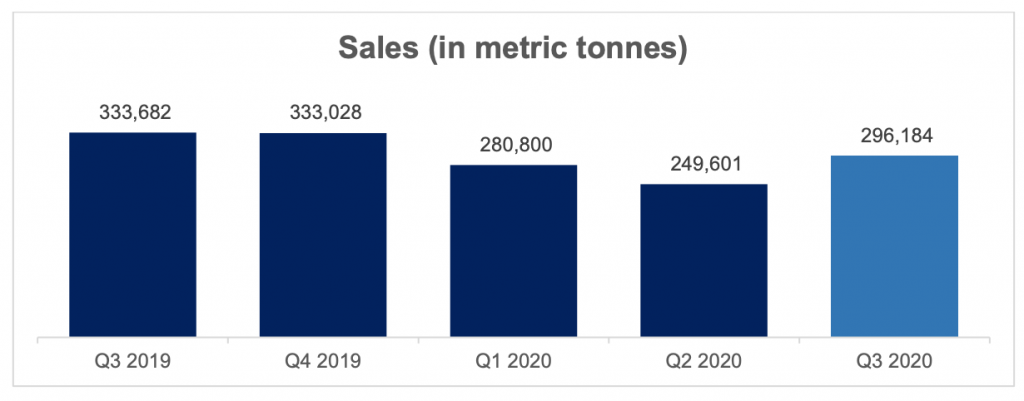

The Group’s sales volumes for Q3 2020 is 296,184 MT, higher by 19% from Q2 2020, but 11% lower than 333,682 MT in Q3 2019. Despite improvement in market sentiment during the current quarter, customers have remained relatively cautious as compared to Q3 2019.

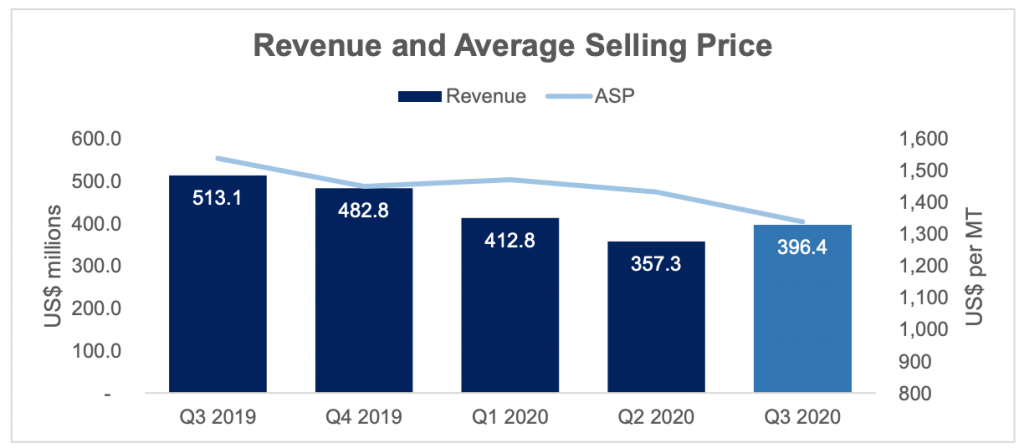

Q3 2020 revenue of US$396.4 million has improved 11% from Q2 2020, but remained lower than US$513.1 million recorded for Q3 2019, due to lower delivered volumes as well as lower average realised selling prices. This is in line with the lower average SICOM1 prices for YTD September 2020 of US$1,241 per MT, as compared to US$1,418 for YTD September 2019.

1Refers to SICOM TSR20 1st position.

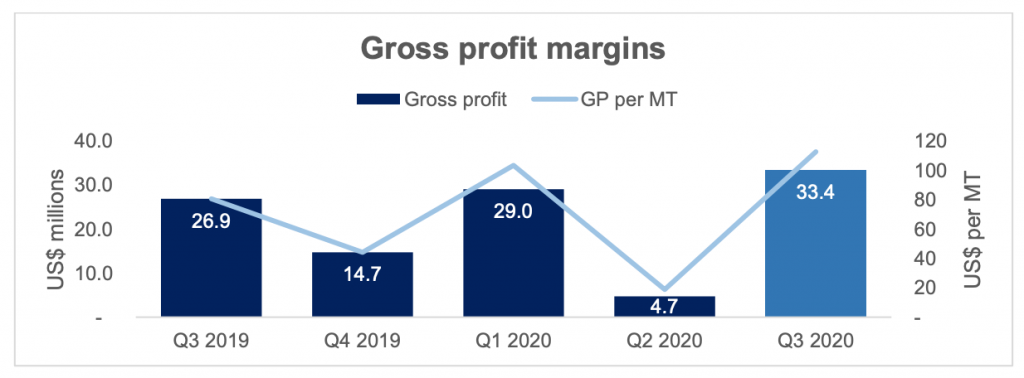

The Group has reported a 24% improvement in gross profit from Q3 2019 amid declining revenues, from US$26.9 million in Q3 2019 to US$33.4 million in Q3 2020. This also represents a seven-fold jump from Q2 2020, which reflects the Group’s continued focus in capturing margins from in-house volume. The higher rubber prices during Q3 2020 have seen gross profit margins improved from US$81 per MT in Q3 2019 to US$113 per MT in Q3 2020.

Buoyed by strong margins, the Group’s EBITDA improved from US$2.4 million in Q3 2019 to US$10.9 million in Q3 2020.

Industry trends and outlook

Natural rubber prices, indicated by SICOM TSR20 1st position, have started the quarter at US$1,140 per MT, and closed the quarter at US$1,357 per MT. It has since gone to peak at US$1,764 on 28 October 2020, but subsequently retreated back to US$1,579 per MT on 25 November 2020. This is still a higher level than that at the beginning of 2020.

Halcyon Agri maintains that natural rubber is a critical ingredient for global mobility and an indispensable ingredient in the production of personal protective equipment. Whilst an immediate v-shaped rebound for the natural rubber industry is not expected, we remain cautiously optimistic that the recovery trend observed in Q3 2020 will continue into 2021.

In addition, the recent positive news on the trial efficacy of the coronavirus vaccines may potentially be the catalyst propelling the recovery of the global economy which has a direct impact on the demand for natural rubber. Li Xuetao, Chief Executive Officer of Halcyon Agri said, “The Group has been able to take advantage of the recovery in rubber prices to capture higher margins, and 26.9 14.7 29.0 4.7 33.4 – 20 40 60 80 100 120 – 10.0 20.0 30.0 40.0 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 US$ millions US$ per MT Gross profit margins Gross profit GP per MT 2.4 39.2 3.6 (17.4) 10.9 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 EBITDA Page 4 of 4 capitalise on the improved demand to ramp up its factory utilisation during the quarter. With the successful completion of the issuance of perpetual securities, the Group is now in good shape heading into 2021, to scale up its operations and capitalise on opportunities in the post-pandemic economy.”

He added, “Considering the recent bullish macro-economic sentiments, we are cautiously optimistic that, barring unforeseen circumstances, Halcyon Agri’s operating conditions for the rest of the year would be better than that of the first half of 2020.”