Halcyon Agri Reports Steady Q1 2022 Performance

SINGAPORE, 20 May 2022 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) today provides voluntary business update for the first quarter ended 31 March 2022 (“Q1 2022”).

During the fiscal quarter, the Group continued to display financial and operational resilience amid macro-economic uncertainties arising from the Russia-Ukraine conflict, and partial COVID-19 lockdowns in China.

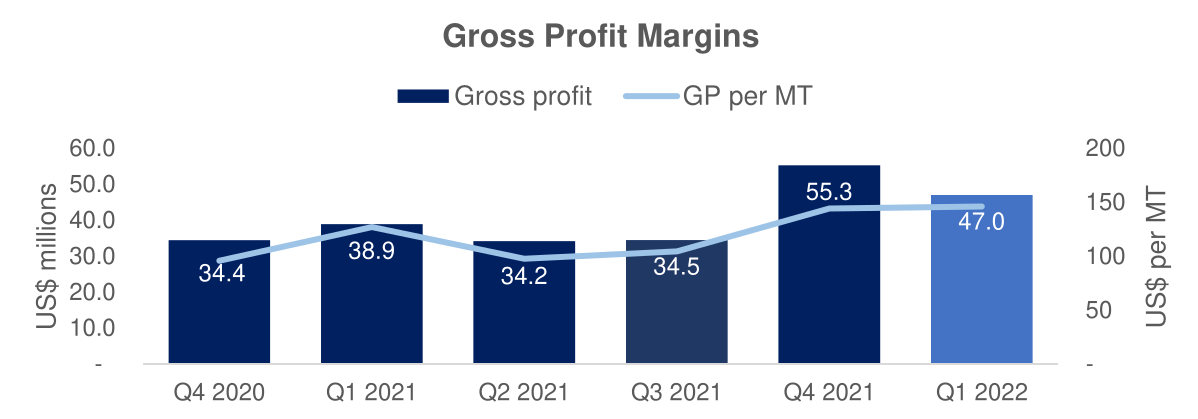

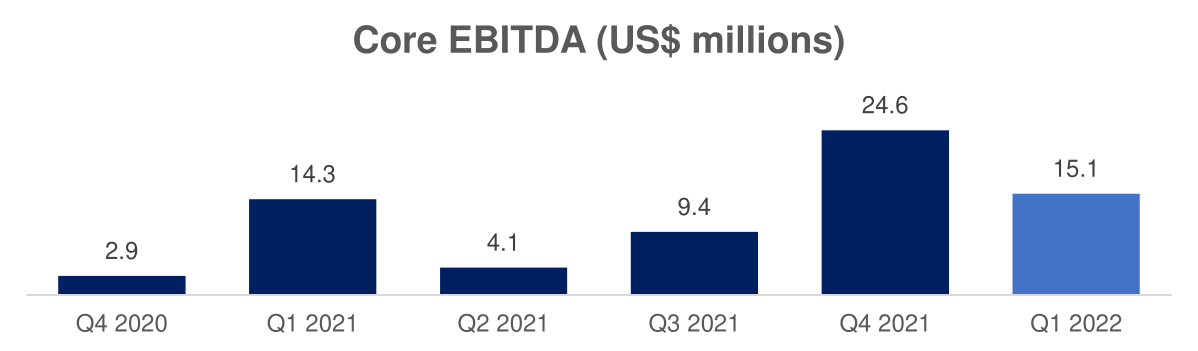

Revenue increased by 18.9% to US$617.3 million in Q1 2022, on the back of higher sales volume and higher average selling prices. Gross profit grew in tandem from US$38.9 million in Q1 2021, to US$47.0 million in Q1 2022. As a result, the Group’s Core EBITDA improved to US$15.1 million in Q1 2022, and registered a profit before tax.

Overall, the Group recorded broad-based improvement across its business segments – Halcyon Rubber Company (“HRC”) and Corrie MacColl International (“CMCI”), driven by higher sales volume and better unit margins. These are testament to our ability to capture market demand and enhance cost efficiencies effectively. Notwithstanding the Group’s Q1 2022 performance, the global supply chain issues remain pronounced, and may intensify in the near term due to the ongoing COVID-19 situation in China.

During Q1 2022, the Group’s upstream business unit, Corrie MacColl Plantations (“CMCP”) made an operating loss due to low yielding wintering season. CMCP’s performance is expected to improve in the coming quarters, and it has also commenced tapping on c.2,500 hectares of new plantations areas, in line with its business plans. The progressive opening of new areas will contribute to increased production of c.2,000 mT per annum in the initial year and will ramp up as the trees continue to grow. The incremental yields from maturing plantations are expected to generate positive returns in the near future from its long-term investment over the past years, and may be further boosted by the rubber price upcycle.

Core EBITDA referred herein excludes items which are non-operational in nature, including fair value changes in biological assets and investment properties, disposal gains and one-off expenses.

Industry Trends and Outlook

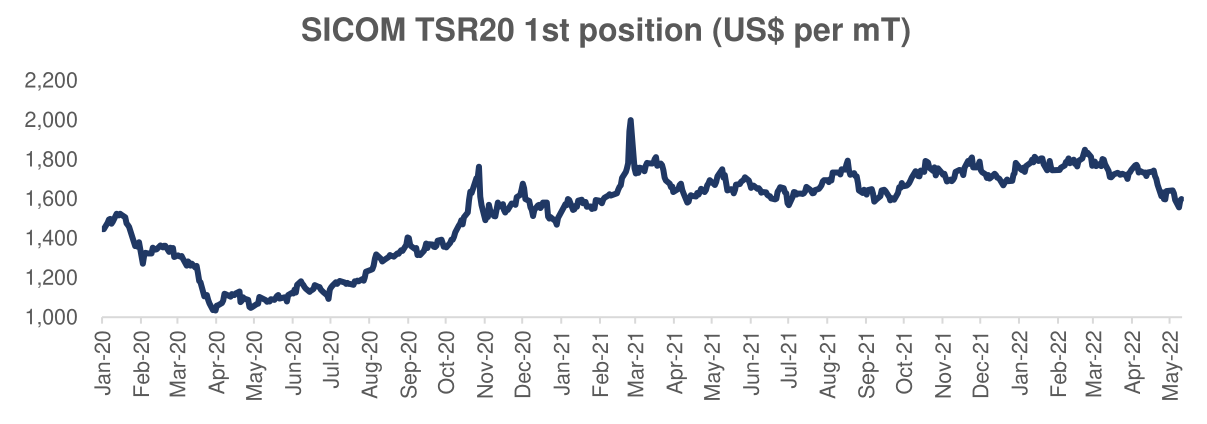

Rubber prices were on the uptrend in the beginning of the year. However, against the backdrop of Russia-Ukraine conflict and lockdowns in certain regions in China, downward pressure has been observed since February 2022. Near-term concerns about the Fed’s interest rate hike and inflationary risk have also further mounted pressure on the rubber market.

CEO Remarks

Commenting on the Group’s Q1 2022 performance and progress, Mr Li Xuetao (李雪涛), Chief Executive Officer said, “The natural rubber market continues to gain momentum, and the market conditions have improved since the beginning of the COVID-19 outbreak in 2020. We expect more macro headwinds in 2022, arising from geopolitical and inflation risks. Notwithstanding the near-term factors, the demand for natural rubber remains sturdy, as it is necessary for daily usage. The expected ramping up of global mobility will also boost the usage of tyres and natural rubber.”

“The volatility in rubber prices does not reflect the actual cost of production for natural rubber, especially at the smallholders’ level, which disincentivised farmers to continue with tapping. In the face of tightening supply, immediate collective action is warranted from the whole natural rubber industry.”

“The Group maintains its view that the mid to long-term supply and demand dynamics of natural rubber remain favourable, and will support its prices. In the meantime, we continue to collaborate closely with our customers in navigating through challenges, while maintaining a tight and effective risk management framework.”

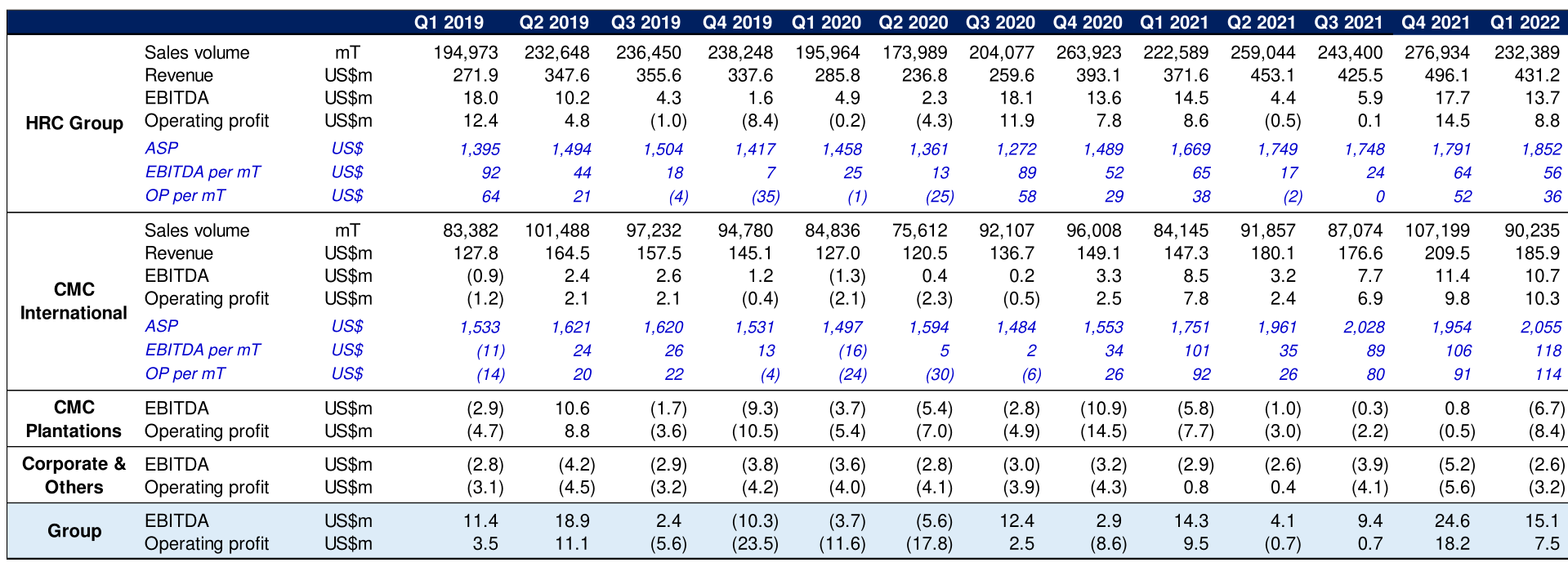

Financial Performance Summary

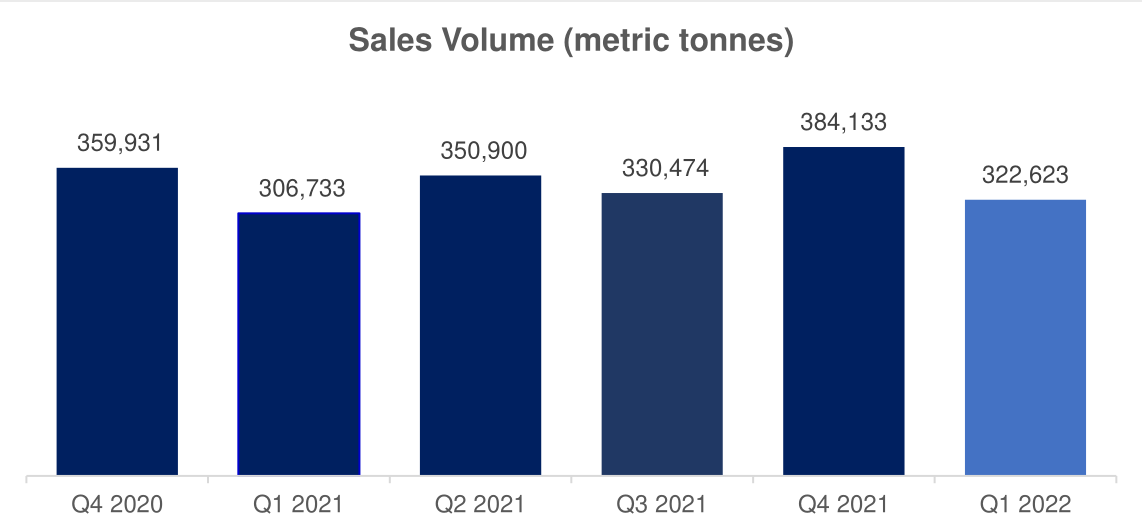

Q1 2022 sales volume grew from 306,733 mT in Q1 2021 to 322,623 mT, attributed to the Group’s timely capture of market demand through close collaborations with its customers.

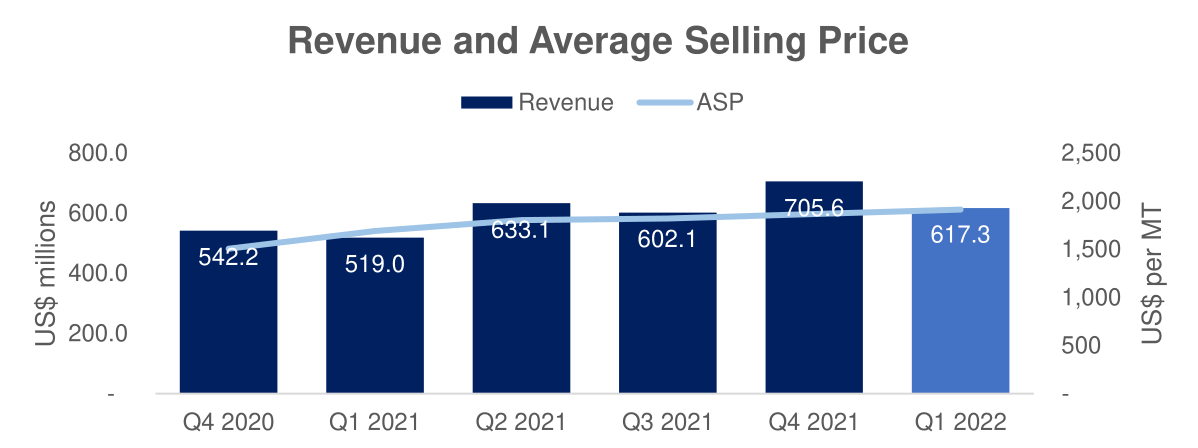

Q1 2022 revenue of US$617.3 million represents an increase of 18.9% from US$519.0 in Q1 2021. The Group’s revenue increase aligns with the uptrend in its sales volume and average selling prices.

The Group reported a 20.8% increase in gross profit from US$38.9 million in Q1 2021 to US$47.0 million in Q1 2022. Gross profit per mT continues to improve, a testament to the Group’s effective commercial management strategies.

Buoyed by the improvement in gross profits, the Group achieved a core EBITDA of US$15.1 million in Q1 2022.

Please refer to the Appendix for the summary of operating statistics.

###

About Halcyon Agri

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

Email: