Halcyon Agri Reports H1 2023 Results

SINGAPORE, 14 August 2023 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) today announced its financial performance for the half year ended 30 June 2023 (“H1 2023”).

Hainan Rubber Group (“HRG”) had completed its acquisition of 36% stake in Halcyon Agri on 3 February 2023, and became the majority shareholder of the Company after accumulating a 68.103% stake upon the closing of the mandatory cash offer on 24 April 2023.

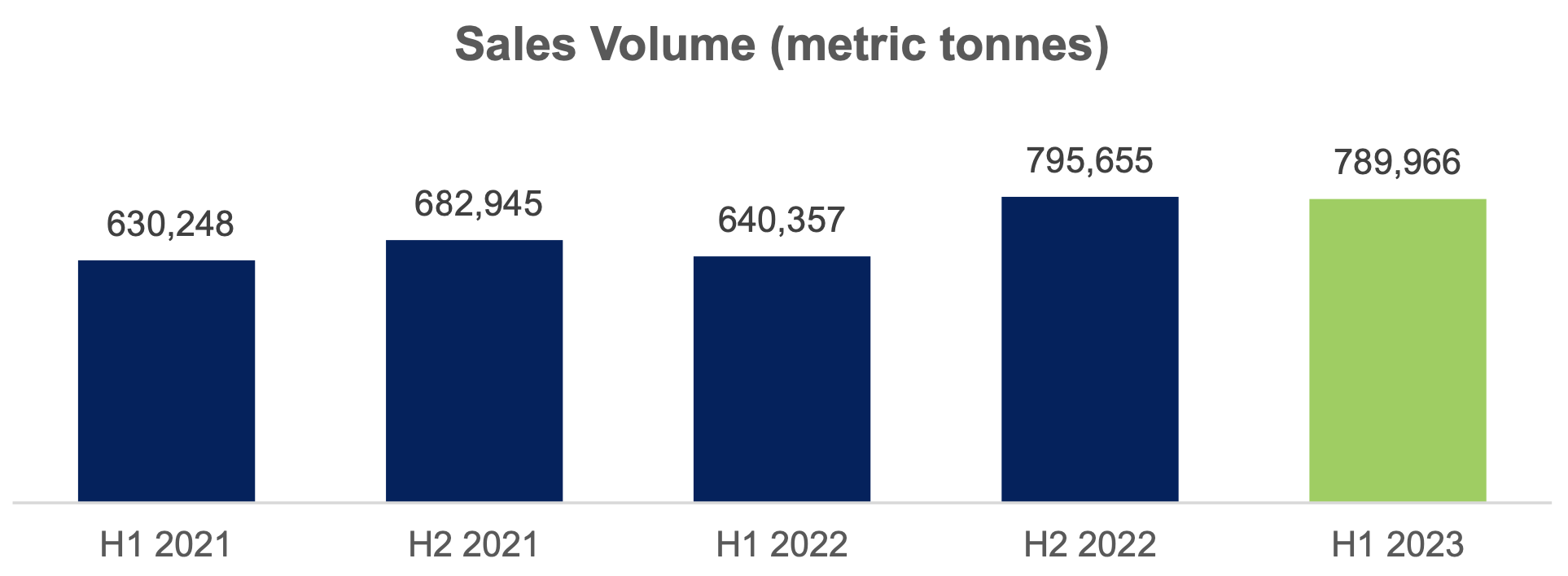

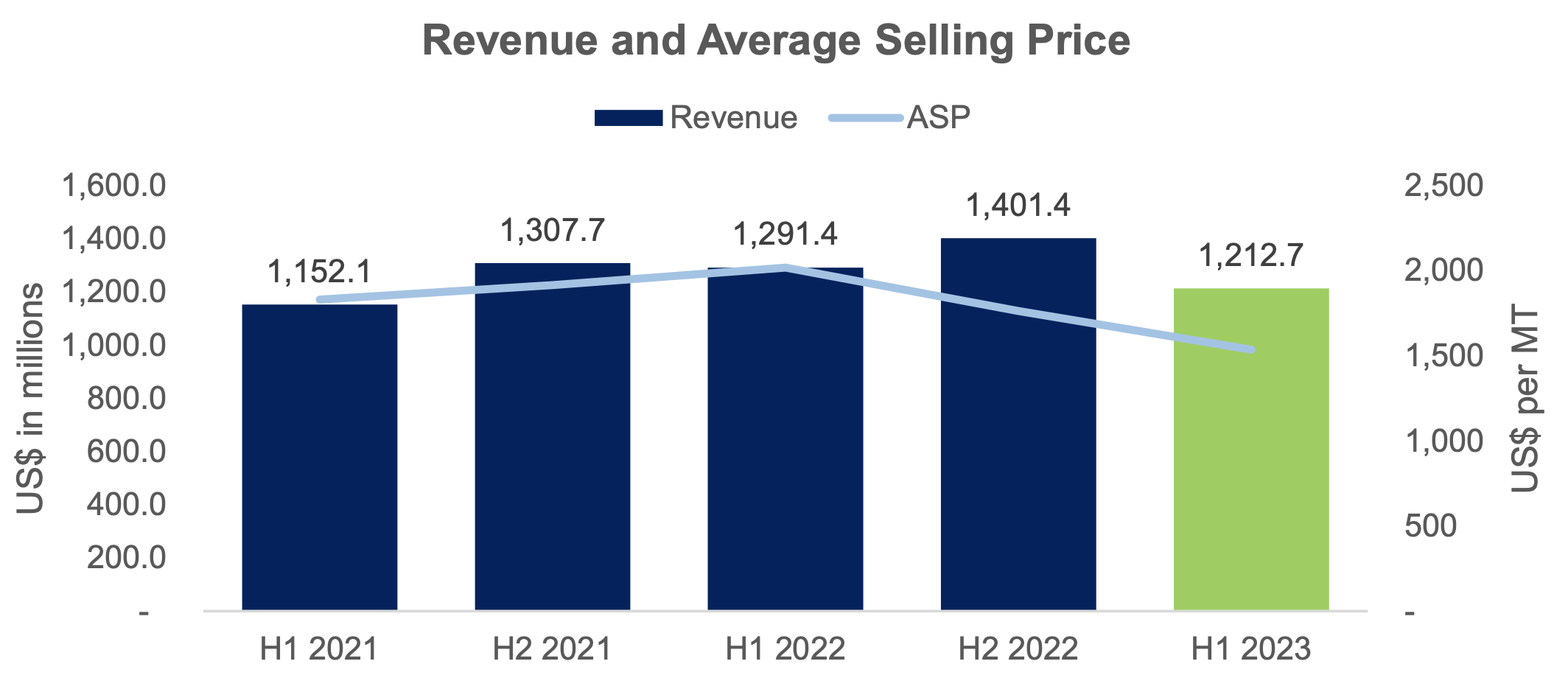

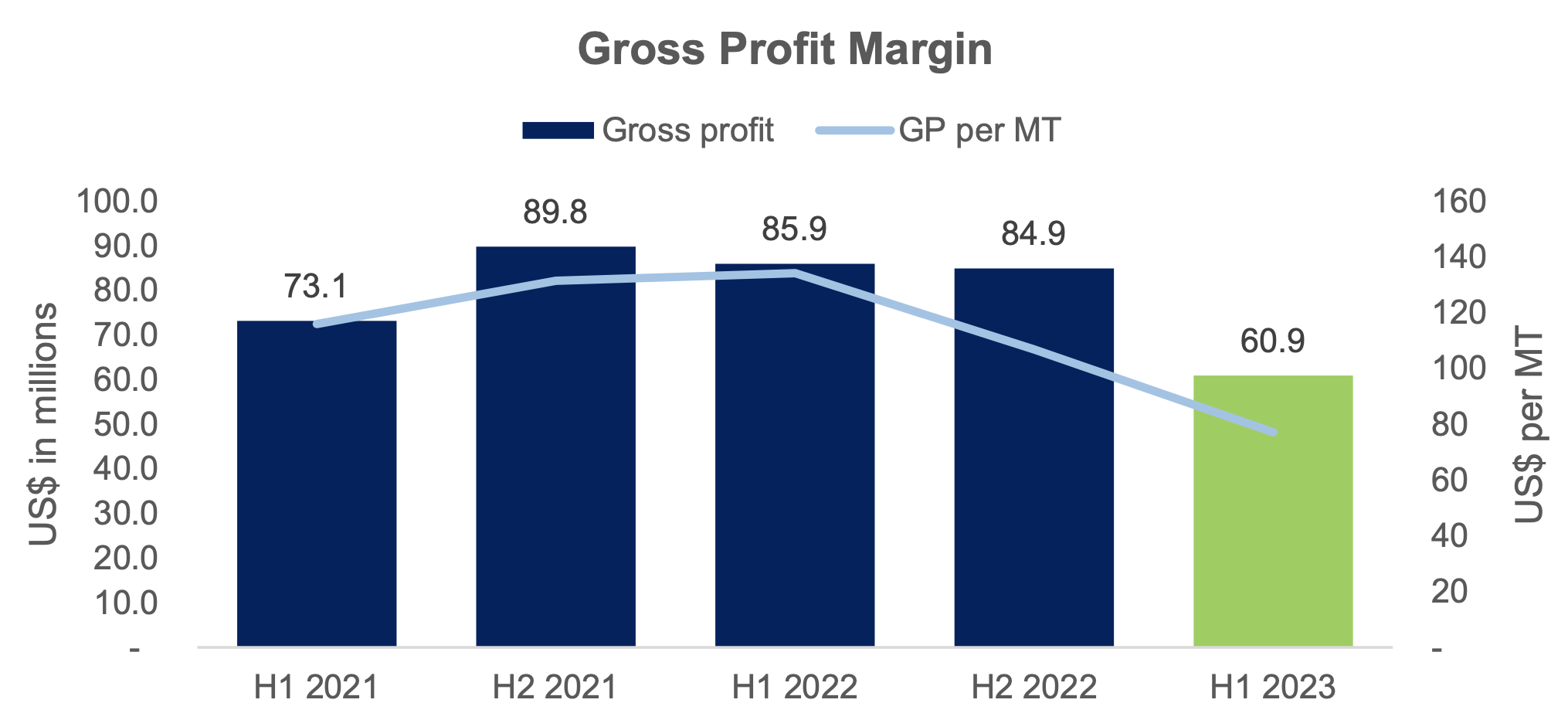

Against the backdrop of fragile global economic recovery and ongoing developments, the Group has begun to realise synergies from its integration with HRG through an enlarged customer platform, particularly in China. As a result, sales volume increased to 789,966 mT in H1 2023. However, revenue had slightly decreased to US$1,212.7 million in H1 2023, due to the rubber price trend during the period. Gross profit lowered to US$60.4 million in H1 2023, caused by the margin compression across key origins, as the decline in rubber prices was met with the increase in raw material costs driven by scarcity.

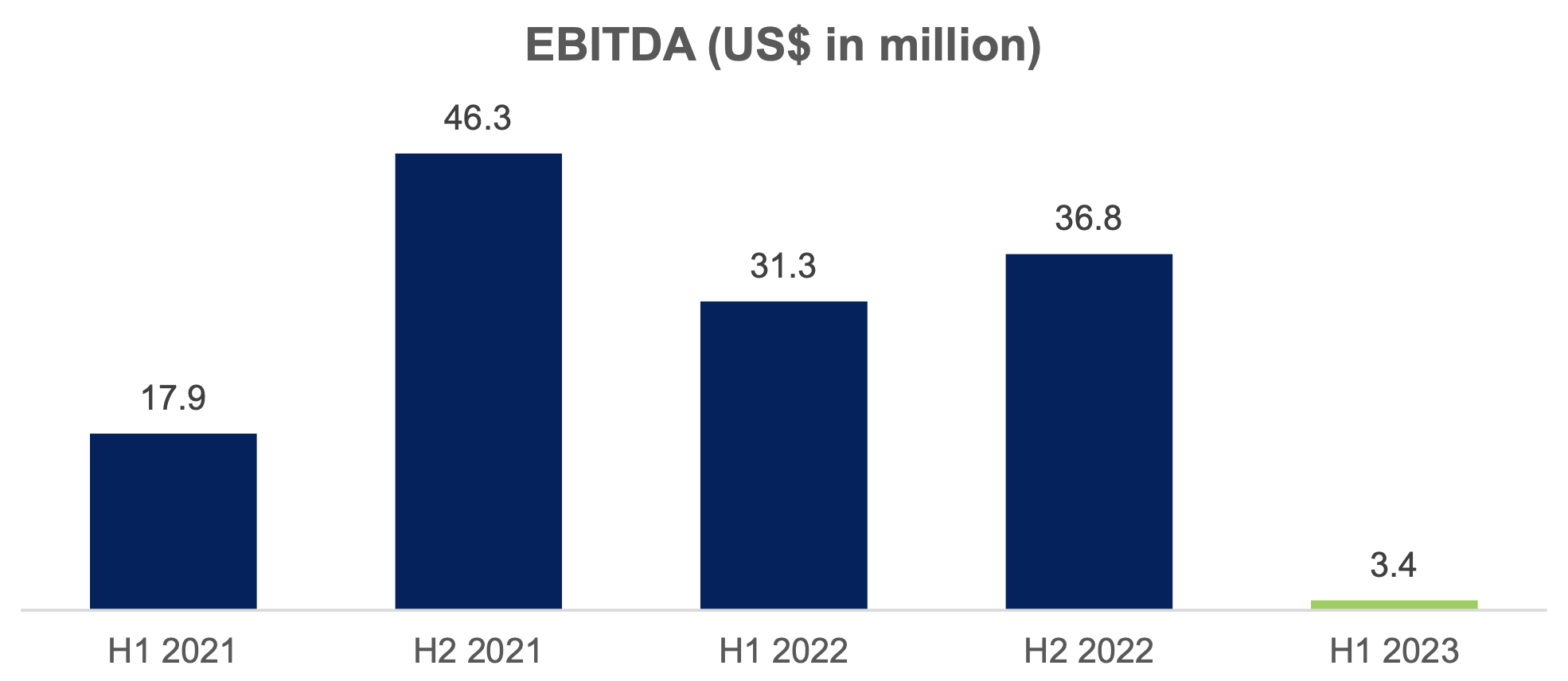

In tandem with the movement of our gross profit, the Group’s EBITDA stood at US$3.4 million. After accounting for the effect of higher financing costs and exceptional costs, the Group reported a loss after tax in H1 2023.

Progress update of refinancing exercises

The Group had successfully closed two syndicated loans to refinance its existing indebtedness which came due. The completion of the exercises above signifies the strong support from Halcyon Agri’s major corporate shareholders, HRG and Sinochem International Corporation (“Sinochem”), as well as the confidence of the banks in the Group’s prospects.

Syndicated loan 1

On 19 June 2023, the Company announced that it had closed a syndicated 1-year working capital loan amounting to US$189.6 million (may be upsized to US$300 million). The Mandated Lead Arranger for the facility is Industrial and Commercial Bank of China Limited, with participation from various Chinese banks in the syndication.

Syndicated loan 2

On 31 July 2023, the Company announced that it had closed a 1-year sustainability-linked syndicated loan with an amount up to US$300 million. The Mandated Lead Arranger, Bookrunner Coordinating Bank, and Sustainability Advisor of the facility is China CITIC Bank International Limited. The facility features sustainability-linked elements, for which the interest rate will be tied to the Group’s achievement of ESG-related KPIs such as power and water consumption intensity, and the traceability of the Group’s sourcing.

The above is a testament to the Group’s ongoing efforts to tap on emerging green and sustainability-linked financing opportunities.

In H2 2023, the Group will continue to expedite the remaining refinancing plan to address its financing tenor, reduce financing costs and replace the bridge loan extended by HRG and Sinochem.

Exceptional Items in H1 2023

During H1 2023, the Group took further steps in addressing several outstanding legacy matters, all of which resulted in a total US$28.9 million charge in the Group’s profit or loss in 2023.

Provision of expected credit loss on loan receivables from third party – US$20.9 million

During H1 2023, the Company, along with a syndicate of lenders, had sought to recover an outstanding loan from a third party. Despite the one-off charge in income statement, the recovery of circa US$40 million of funds would be re-allocated to reduce the Group’s leverage.

Settlements with local governments – US$8.0 million

During H1 2023, the Group concluded negotiations with local governments in the African region over various disputes, some of which were legacy items, that had affected the Group’s operations.

Moving forward, the Group does not foresee these items to recur.

CEO’s Remarks

Commenting on the Group’s H1 2023 outcome, Mr Li Xuetao (李雪涛), Chief Executive Officer said, “Amid the operational challenges experienced during the fiscal period, Halcyon Agri has taken the initial steps to collaborate with HRG for integration opportunities, and we will continue to venture in this direction. Considering the overall macroeconomic uncertainties, the operating conditions in H2 2023 are expected to remain challenging, for which we anticipate a demand recovery in Q4 2023. Our continued focus on operational and financing cost control becomes even more critical to remain competitive in the market. We remain cautiously optimistic over Halcyon Agri’s prospects, and confident in our collective ability to navigate the challenges.”

Financial Performance Summary

H1 2023 sales volume rose to 789,966 mT from 640,357 mT in H1 2022, attributed to the Group’s effective commercial strategy and expansion of rubber trading in China.

H1 2023 revenue slightly decreased to US$1,212.7 million from US$1,291.4 million in H1 2022, in tandem with the market price movement in recent periods.

The Group reported gross profit of US$60.9 million in H1 2023, compared with US$85.9 million in H1 2022, as we battled the effects of margin compression amid higher raw materials costs.

The Group’s EBITDA of US$3.4 million in H1 2023 moved in tandem with our gross profit.

###

About Halcyon Agri

Halcyon Agri is a leading supply chain franchise of natural rubber with global presence. Headquartered in Singapore and listed on the Mainboard of Singapore Exchange (SGX: 5VJ), the Group owns and operates significant assets along the natural rubber value chain, and distributes a range of natural rubber grades, latex and specialised rubber for the tyre and non-tyre industries. It has 37 processing factories in most major rubber producing origins with production capacity of 1.4 million mT per annum, and is one of the largest owners of commercially operated rubber plantation globally.

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 35 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0843

Email: