Halcyon Agri Remains Resilient Despite Operational Headwinds

- FY2022 Profit Before Tax of US$7.1 million

- Steady growth in sales volume and EBITDA, a testament to our supply chain management capability to capture market opportunities

- Hainan Rubber completed acquisition of 36.00% stake in Halcyon Agri, and launched a Mandatory Cash Offer (“MGO”)

SINGAPORE, 28 February 2023 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) today announced its financial performance for the full year ended 31 December 2022 (“FY2022”). The Group continued its profitable performance and maintained a profit before tax position of US$7.1 million.

Throughout FY2022, the global environment remained challenging with ongoing Russia-Ukraine conflict and COVID-19 lockdown restrictions in China, exacerbated by rapid interest rate hikes, all of which affected the downstream demand. Notwithstanding the volatile market conditions in 2022, the Group effectively navigated the situation, and registered improvement on both financial and operational fronts.

The Group’s revenue grew to US$2.7 billion in FY2022, bolstered by the increase in both sales volume and average selling prices. Operating profit increased by 13.9% from US$36.1 million in FY2021 to US$41.1 million in FY2022, on the back of gross profit increase, reflective of our focus in strengthening customer relationship, managing working capital and reducing overall leverage. The Group’s EBITDA expanded in tandem to US$67.4 million in FY2022.

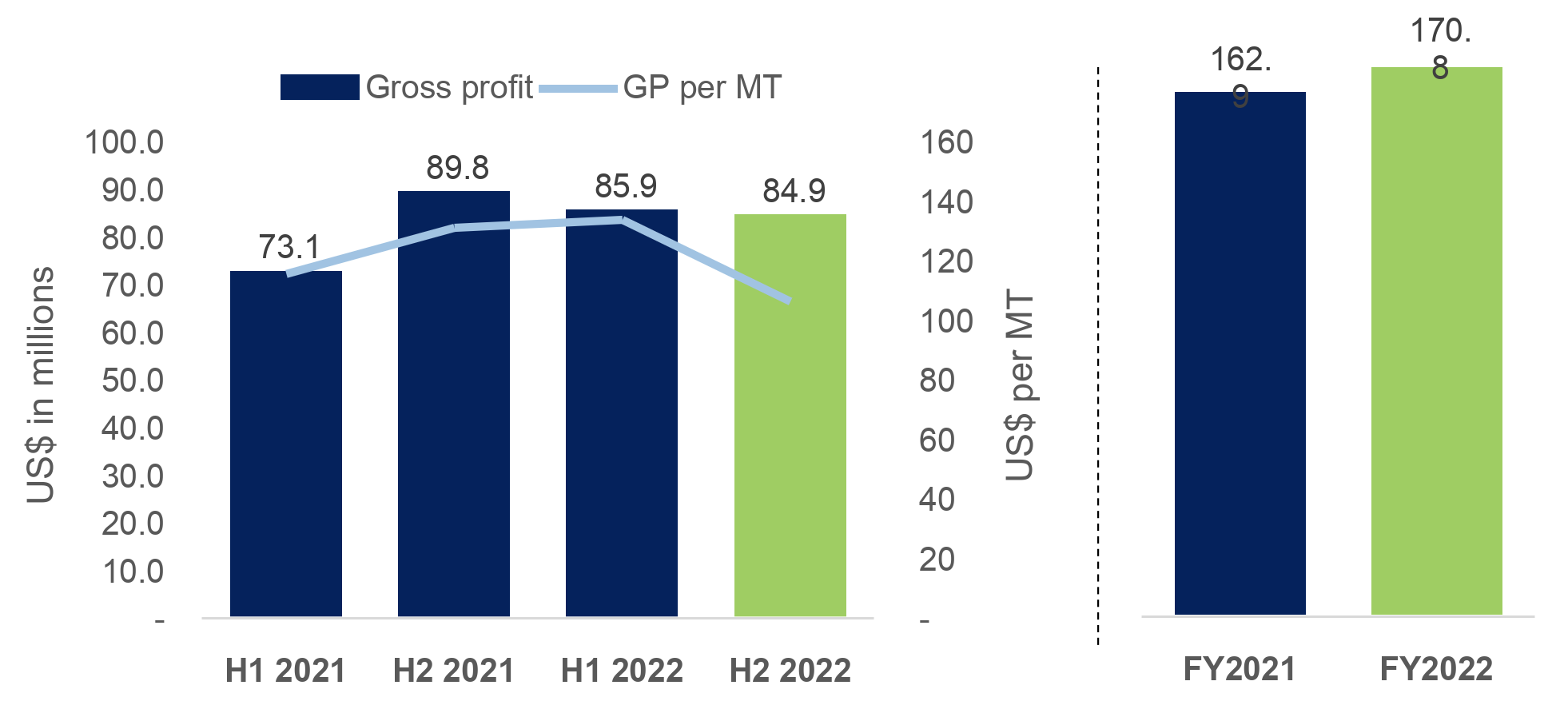

Segmental Overview

The Group’s key business segments, Corrie MacColl International (“CMCI”) continued to capitalise on the steady demand in Europe and United States, while Halcyon Rubber Company (“HRC”) was affected by persistent margin compression in key origins, as well as China lockdown measures imposed during the year. The impact on HRC business segment was partially offset by management’s deleveraging initiatives, of which the disposals of non-core assets were conducted at favourable prices, realising US$15.3 million gains in FY2022. On the other hand, Corrie MacColl Plantations’ (“CMCP”) yields increased from 17,860 mT in FY2021 to 20,751 mT in FY2022 as new areas became mature for tapping. We continue to optimise our costs to keep pace with the market price movement.

In view of the high interest rate environment and overall macroeconomic uncertainty, the Group remains prudent in its capital allocation measures and working capital management. The key result of these actions is the reduction of cash conversion days from 86 days in FY2021 to 81 days in FY2022.

Strategic Entry of Hainan Rubber

On 3 February 2023, China Rubber Investment Group Company Limited, a direct wholly-owned subsidiary of China Hainan Rubber Industry Group Co., Ltd (“Hainan Rubber”) completed its acquisition of 36.00% stake (574,204,299 ordinary shares: US$0.315 per share) in Halcyon Agri from Sinochem International (Overseas) Pte. Ltd., and launched a Mandatory Cash Offer to acquire all the issued and paid-up ordinary shares of Halcyon Agri it does not own at S$0.413 per share in cash. The formal offer is dependent on shareholders’ acceptance condition. The Group will make further announcement as and when there is material development.

CEO Concluding Remarks

Commenting on our FY2022 performance and 2023 outlook, Mr Li Xuetao (李雪涛), Chief Executive Officer said, “Looking back the past two years, I would describe Halcyon Agri as resilient. Despite the challenging and uncertain market conditions, the Group continued to deliver solid results to our stakeholders, and achieved encouraging progress on all fronts. These will not be possible without the collective efforts of Halcyon Agri team. Looking ahead, 2023 global economy will comprise of various key subjects: rising interest rates, impending global recession amid inflationary environment and China’s reopening of its economy, all of which would influence the global consumption of natural rubber. As the world population settles itself into the macroeconomic changes, the demand upswing is likely to be observed in second half of 2023. The Group remains cautiously optimistic towards the natural rubber industry prospects, as the supply and demand dynamics remain favourable in the mid-to-long term.”

“Also, we are pleased to welcome onboard our new strategic shareholder, Hainan Rubber, one of the world’s leading natural rubber enterprises. We look forward to collaboration opportunities with Hainan Rubber in our journey to pursue excellence and mutual growth, and deliver exceptional value to our trusted partners.”

H2 2022 and FY2022 Financial Performance Summary

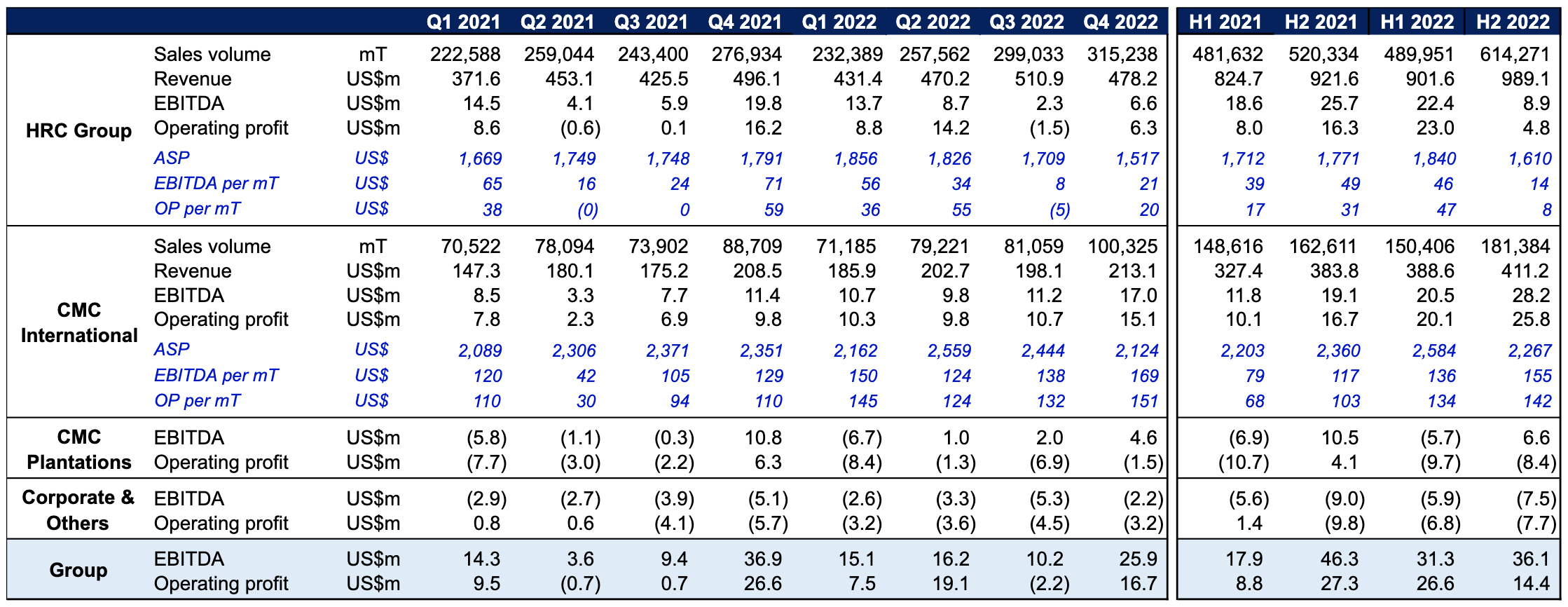

Sales Volume (Metric Tonnes)

The Group maintained its sales volume momentum from past periods. H2 2022 and FY2022 sales volume improved to 795,655 mT and 1,436,012 mT respectively, on the back of demand increase across both tyre and non-tyre sectors.

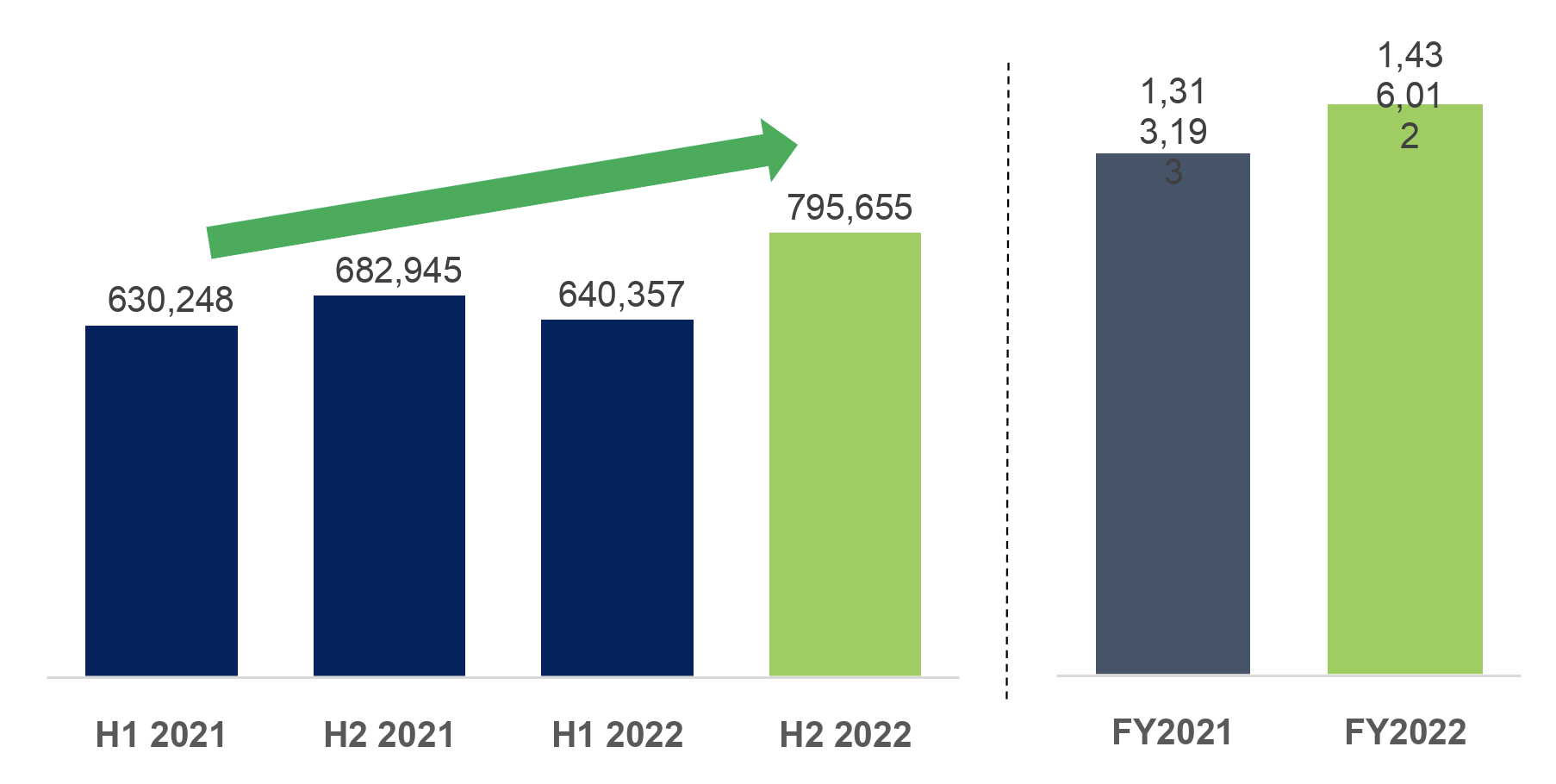

Revenue and Average Selling Price

The Group maintained higher average selling price (“ASP”) of US$1,875 per mT in FY2022. H2 2022 and FY2022 revenue represented increases to US$1.4 billion and US$2.7 billion respectively.

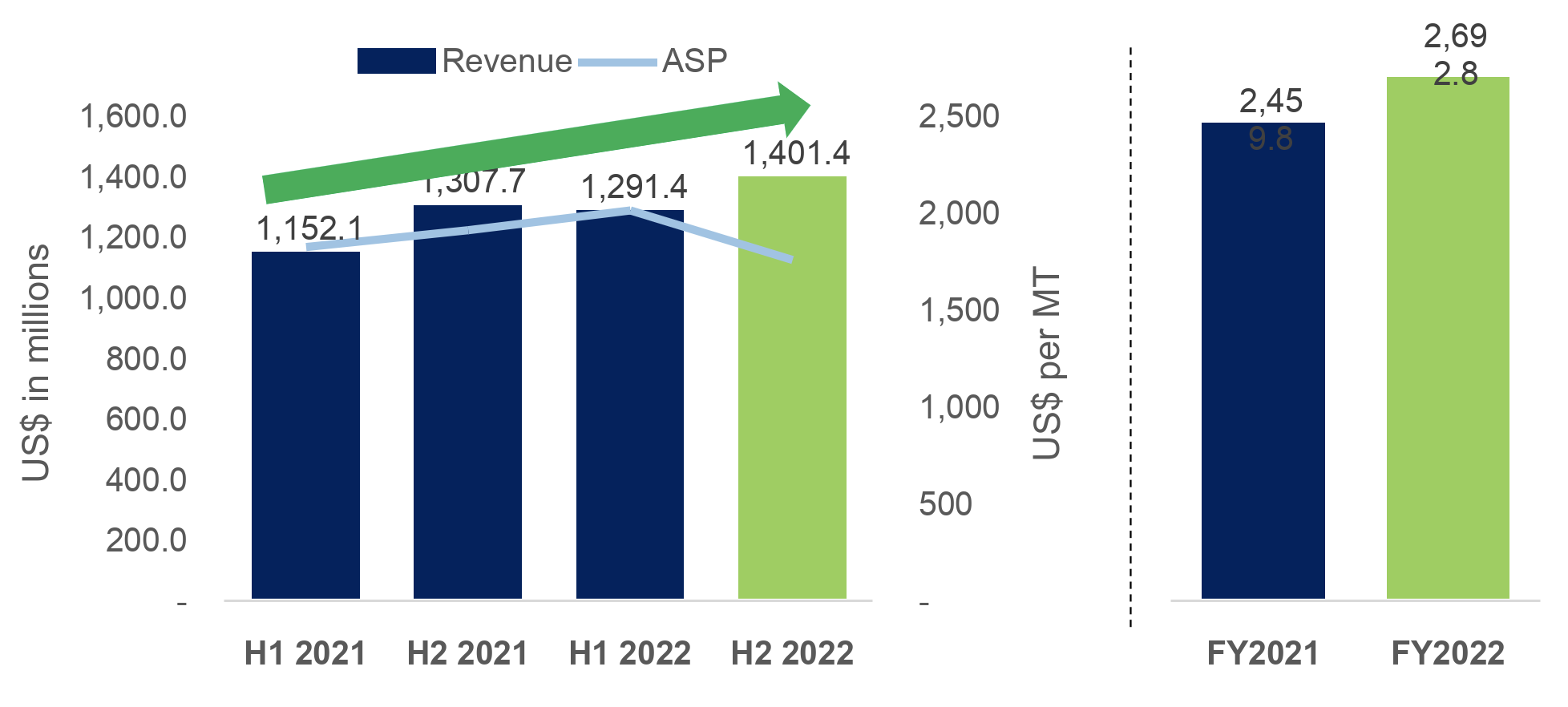

Gross Profit Margin

The Group registered overall gross profit improvement to US$170.8 million in FY2022. H2 2022 gross profit stood at US$84.9 million.

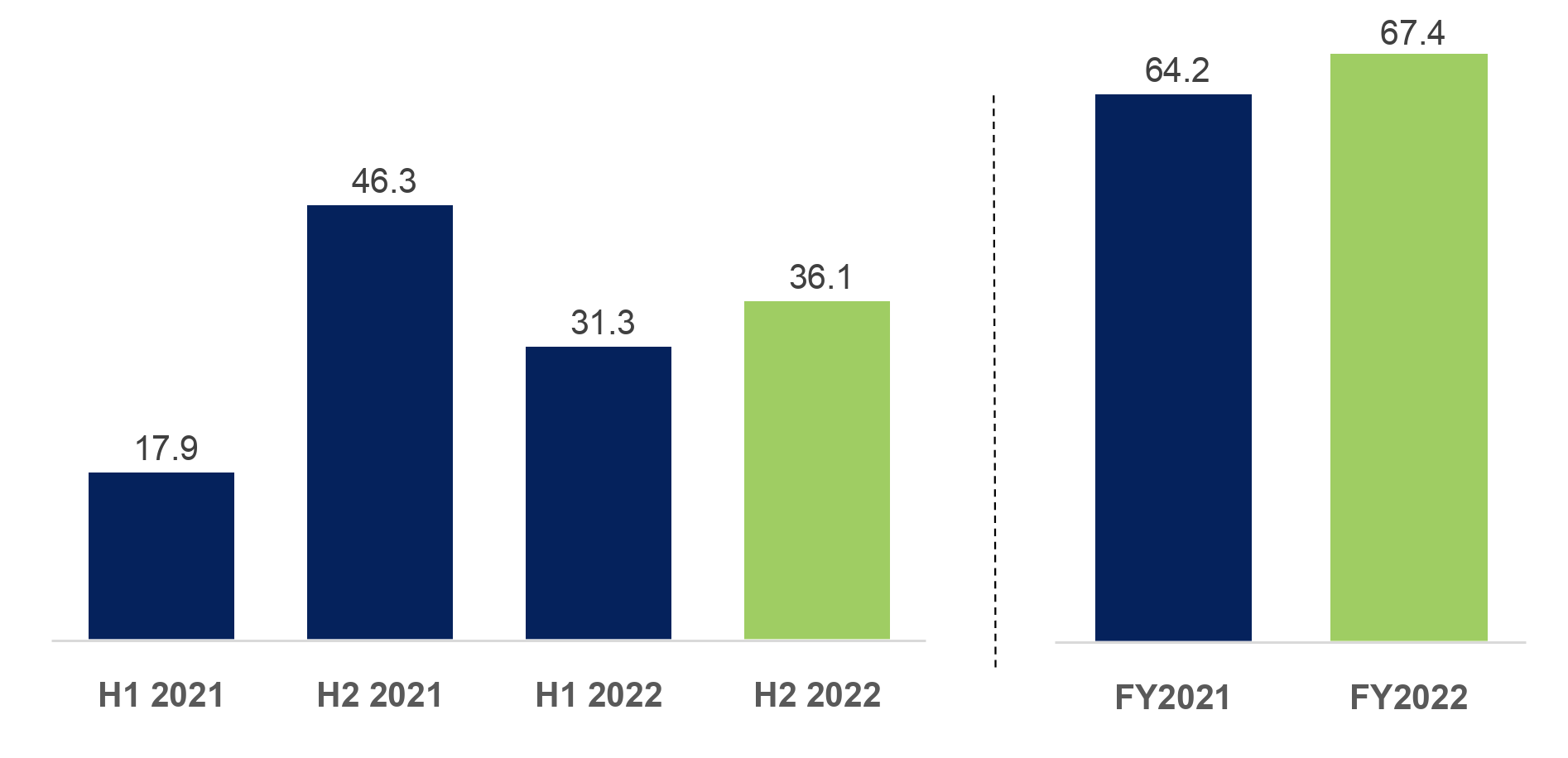

EBITDA (US$ in million)

In tandem with gross profit alignment, the Group’s EBITDA rose to US$67.4 million in FY2022 from US$64.2 million in FY2021.

Please refer to the Appendix for the summary of operating statistics.

###

About Halcyon Agri

Halcyon Agri is a leading supply chain franchise of natural rubber with global presence. Headquartered in Singapore and listed on the Singapore Exchange (SGX: 5VJ), the Group owns and operates significant assets along the natural rubber value chain, and distributes a range of natural rubber grades, latex and specialised rubber for the tyre and non-tyre industries. It has 38 processing factories in most major rubber producing origins with production capacity of 1.6 million mT per annum, and is one of the largest owners of commercially operated rubber plantation globally.

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

Email:

Appendix – Selected Operating Statistics Summary