Halcyon Agri Posts US$17.1 Million Net Profit in FY2021, Reverses Prior Year Loss

- Significantly improved performance across all business segments;

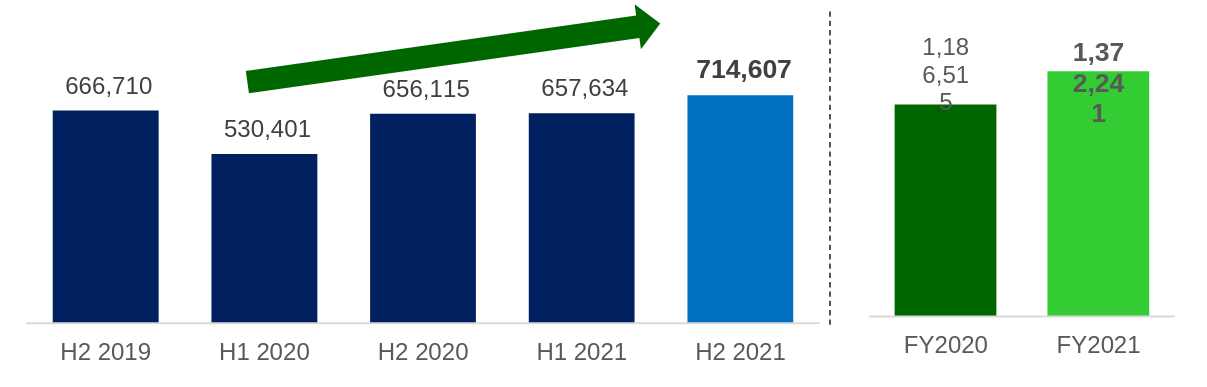

- Sales volume returns to pre-pandemic levels at 1.37 million MT;

- Global footprint and connectivity enabled effective capturing of market opportunities arising from robust recovery momentum;

- Strong support from financial institutions and Sinochem1.

SINGAPORE, 28 February 2022 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) today announced its financial performance for the full year ended 31 December 2021 (“FY2021”). The Group has achieved much improved results both financially and operationally, and registered a net profit of US$17.1 million in FY2021, from a net loss of US$60.6 million in FY2020.

FY2021 is the year where the world is recovering from a disastrous FY2020, where industrial activities in the automotive sector and natural rubber industry were affected by the COVID-19 pandemic. Halcyon Agri, being a world-leading natural rubber producer, with a unique vantage point to the global supply and demand dynamics, has effectively executed its business strategy in accordance with its Pillar of 360° Excellence, to seize market opportunities amid the surge in demand.

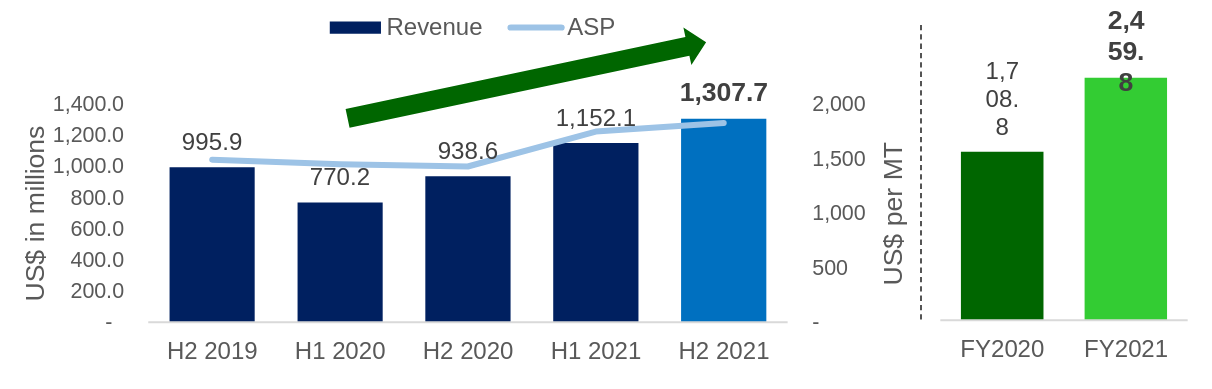

As a result, sales volume increased 15.7% year-on-year (“YoY”), to 1,372,241 MT in FY2021, surpassing FY2019 levels. Buoyed by higher volume and higher natural rubber prices, revenue surged 44% YoY to US$2.45 billion in FY2021.

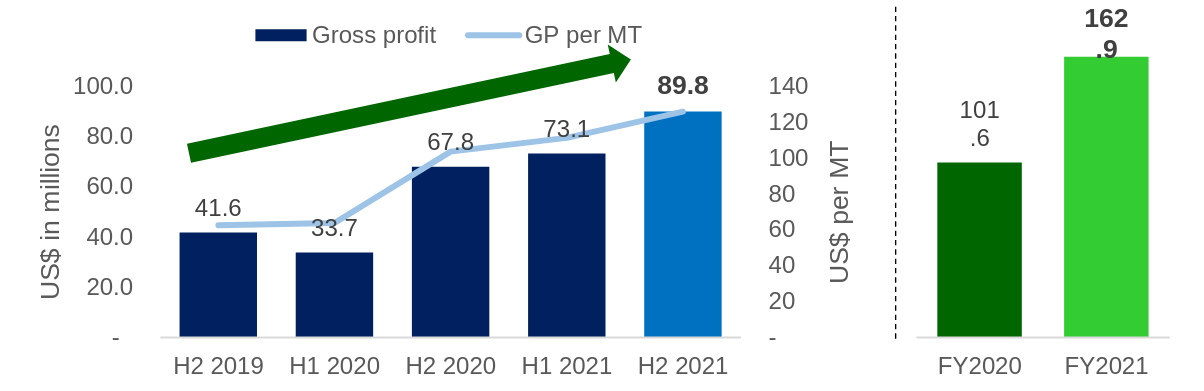

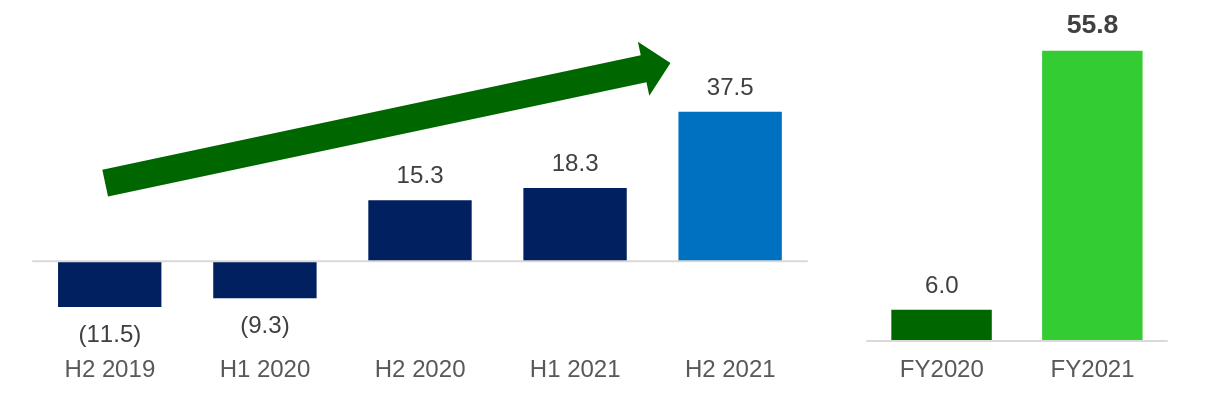

Gross profit increased from US$101.6 million in FY2020 to US$162.9 million in FY2021, on the back of higher volumes and better unit margins. The Group registered EBITDA2 of US$55.8 million in FY2021, from US$6.0 million reported in the preceding year. The increase is attributable to better margins and the realisation of benefits from cost saving initiatives executed over the past two years.

The Group’s key business segments – Halcyon Rubber Company (“HRC”) and Corrie MacColl International (“CMCI”) have both delivered improved results.

HRC has mobilised its global resources effectively, leveraging its scale to meet the downstream demand and achieving a YoY EBITDA improvement of 10.0%. On the other hand, CMCI leveraged the strong demand in destination market, and achieved a substantial increase in its EBITDA in FY2021, through effective customer relationship management. It has collaborated closely with customers to support their supply chain management, amid the global logistics disruption.

Halcyon Agri’s global network and seamless connectivity allows the Group to navigate the logistics crisis, and strengthen its position as a preferred natural rubber supplier.

Corrie MacColl Plantations (“CMCP”) continued to narrow its losses as a result of higher prices, conscious cost management, and higher yields in line with plantation maturity. Plantation yields in FY2021 was 18,249 MT, 24% higher than 14,701 MT in FY2020. The anticipated improvements in rubber prices over the coming years will start to generate positive returns on the long-term investment made by the Group in the past few years.

Leveraging the Group’s global production capability

The increased demand from customers allowed the Group to manage its global production capacity much more effectively. The Group’s FY2021 production volume is 869,699 MT, an increase of 10% from 787,762 MT in FY2020. Despite the global supply chain disruption, the Group’s factories which are strategically located around the world has enabled us to serve the customers in a timely and cost-effective manner. This is the foundation to build a strong and lasting relationship with the customers.

Ramping up its production volumes has allowed the Group to enjoy lower unit costs and achieved economies of scale, which has contributed to the better results in FY2021.

Strong support from institutional stakeholders

On April 2021, the Group has also completed a significant long-term financing of US$300 million3. This successful refinancing of the loans has effectively strengthened its balance sheet structure and has enabled the Group to navigate the challenges in the post-pandemic world and capture opportunities which may arise. Sinochem, the Group’s major shareholder has also provided strong support in the Group’s value creation initiatives.

Unlocking value from deleveraging efforts

The ongoing deleveraging plan to unlock value from non-core assets has also yielded positive results. The successful disposal of certain non-core assets raised US$7.2 million in FY2021, with a remaining US$15.5 million to be received in FY2022 upon completion of the transactions.

Key priorities post-pandemic – ESG and Digitisation

ESG and sustainability are core tenets of our business. Our sustainability track record has been well-recognised by reputable organisations and this has put us in the driving seat to steer the sustainability agenda for the natural rubber industry. Amongst the key achievements are:

- Ranked as the most transparent rubber producing company in the 2021 SPOTT assessment, by the Zoological Society of London4;

- Obtained EcoVadis Gold Medal5;

- A member of Global Platform for Sustainable Natural Rubber (GPSNR) since its launch in October 2018, the Group has fully aligned its Sustainable Natural Rubber Supply Chain Policy to the policy framework of GPSNR6.

Apart from the above, the pioneer initiative of the Group’s digitisation efforts, HeveaConnect, has secured a US$1.5 million investment from Singapore Exchange7 in March 2021.

This move effectively boosted HeveaConnect’s industry traction, facilitated onboarding of producers and customers alike, and accelerated its efforts to digitalise the industry and promote sustainable business practices along the supply chain.

Industry Trends and Outlook – Positive & Upbeat

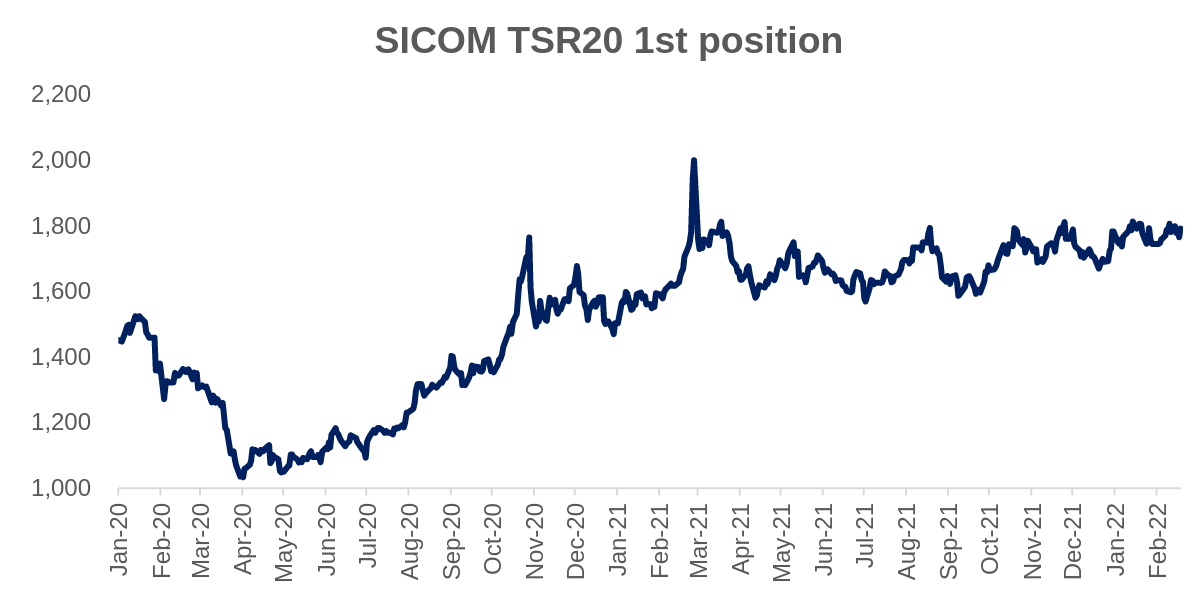

The movement of natural rubber prices (indicated by SICOM TSR20 1st position) in FY2021 is reflective of the significant improvement in the operating conditions in the natural rubber industry. Since the beginning of the year, the prices have surged to a four-year high of US$2,000 per MT in end-February 2021, before retreating to range-trade between US$1,600 to US$1,800 for the remaining of the year, and closing on US$1,730 as of 31 December 2021.

Macro-economic environment remains upbeat. Global economy capped off a strong year in 2021, with final GDP growth estimates by OECD and IMF standing at 5.6% and 5.9% respectively. These organisations have anticipated 2022 GDP growth rates to moderate to 4.5% and 4.4% respectively.

While the natural rubber demand typically moves in tandem with the GDP growth rates, from a short to medium term view, the demand for natural rubber could be boosted by the progressive reopening measures brought in by the various governments. Nonetheless, the global supply chain constraints and logistics disruptions and any potential new variants of COVID-19 remain as downside risks that may affect the demand growth.

On the supply side, challenges pose by the persistent supply constraint in the traditional origins (being Thailand, Indonesia and Malaysia) may change the competitive landscape. Those natural rubber producers with sufficient capital and liquidity will seek alternative raw material sources to supplement their existing sources to sustain their operations and cash flow, while those smaller producers which are unable to adapt to the changing landscape will lose out over time.

The Group maintains its view that the long-term supply/demand dynamics of natural rubber remains favourable. Multiple positive factors, such as governments’ reopening efforts, infrastructure spending to support changing mobility trends and robust economy outlook, would underpin the long-term demand for this key natural resource.

Commenting on the prospects of the industry, Mr Li Xuetao (李雪涛), Chief Executive Officer said, “Looking ahead, the Group remains cautiously optimistic that the operating conditions in FY2022 will remain robust, and bodes well with Halcyon Agri’s natural rubber business, which thrives on global mobility and transportation.”

“We spare no effort to continue our positive momentum and will continue to capitalise on market opportunities to further augment our business, and generate sustainable profits. We also aim to speed up our deleveraging plan, to improve the Group’s liquidity and capital structure.”

Concluding thoughts of the CEO

In his concluding remarks for FY2021, Mr Li said, “We have made great progress on all fronts in 2021. Our result is attributed to effective execution of business strategy, based on our Pillar of 360° Excellence, which enabled us to mitigate the effects of COVID-19 pandemic, in achieving our business objectives. All due credits must go to my team. Certainly, we recognise and want to thank all our stakeholders and business partners for their steadfast support during this tumultuous period.”

H2 2021 and FY2021 Financial Performance Summary

Sales volume (in MT)

The Group achieved growth in sales volume for third consecutive financial periods, maintained the recovery momentum arose from stronger demand and improvements in downstream industrial activities, across both tyre and non-tyre sectors.

Revenue and Average Selling Price

The Group achieved an average selling prices (“ASP”) of US$1,830 per MT in H2 2021, in line with the strengthening of rubber prices over the periods. Buoyed by higher ASP and higher volume, the Group’s H2 2021 revenue increased by 39.3% and 13.5% from H2 2020 and H1 2021 respectively.

Gross profit margins

The Group recorded margin expansion for third consecutive financial periods, testament to the Group’s effective margin capturing strategy.

EBITDA (US$ in millions)

On the back of improved margin across the board, and reduction of plantation losses, the Group achieved EBITDA of US$37.5 million in H2 2021, which is doubled from US$18.3 million in H1 2021, and 145.0% higher than H2 2020.

Please refer to the Appendix below for the summary of operating statistics.

###

About Halcyon Agri

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

Email: [email protected]

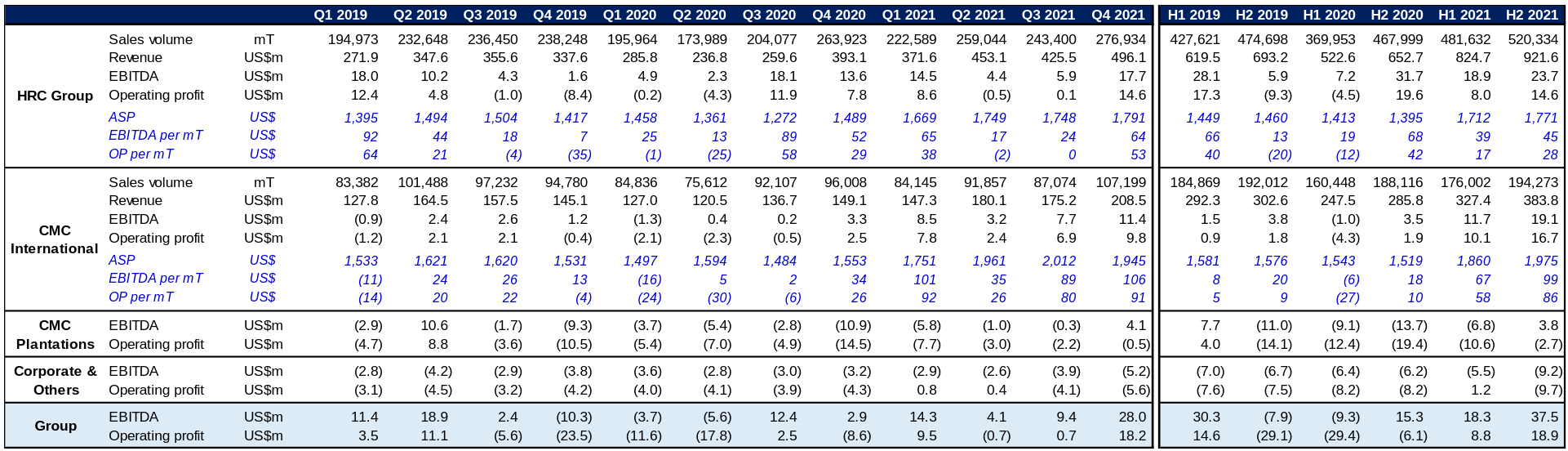

Appendix – Selected operating statistics summary

1Sinochem International Corporation, major shareholder of Halcyon Agri.

2EBITDA referred herein excludes fair value changes in biological assets and investment properties, disposal gains and one-off non-operational expenses, which are non-operational in nature. For context, the FY2021 EBITDA in the financial statements is US$61.1 million.

5https://www.halcyonagri.com/en/press-release/halcyon-agri-provides-corporate-updates/

6https://www.halcyonagri.com/en/press-release/halcyon-agri-aligns-with-gpsnr-policy-framework/

7https://www.halcyonagri.com/en/press-release/sgx-invests-in-heveaconnect/