Halcyon Agri delivers pre-tax profit in H1 2021

- Revenue up by 49.6% from H1 2020, with sales volume returning to pre-pandemic levels

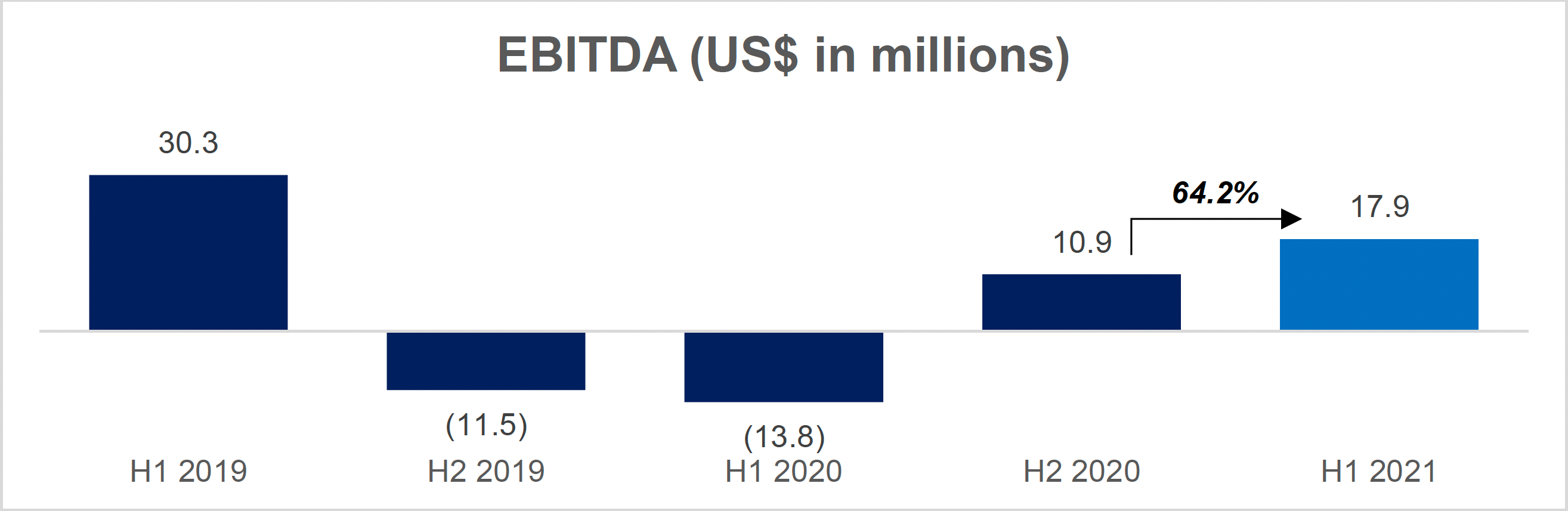

- EBITDA at US$17.9 million, reversing from US$13.8 million loss in H1 2020

- Balance sheet strengthened with completion of financing initiatives

SINGAPORE, 12 August 2021 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”), achieved significant improvement in H1 2021 financial results: Revenue of US$1.2 billion, EBITDA of US$17.9 million and pre-tax profit of US$0.2 million. The improved results are reflective of the Group’s progression in navigating the effects of COVID-19 pandemic.

Leveraging its strong foothold in the global tyre fraternity, HRC capitalises on the tyre demand recovery and improved operating rates of global tyre makers, to capture higher sales. Strong sales volume ensured effective and efficient utilisation of HRC’s 36 factories globally, facilitated the optimisation of the Group’s fixed cost. On the other hand, CMCI’s entrenched presence in destination markets and expertise in supply chain management enabled them to serve their customers effectively amid the global logistical disruptions.

The positive results from HRC and CMCI were offset by costs associated with Corrie MacColl Plantations (CMCP) (which houses the Group’s gestating plantation assets).

At corporate level, the Group recorded a gain from deconsolidation of HeveaConnect, its 49.9% owned associate, after completion investment from SGX in March 2021¹.

Commenting on the Group’s results, Mr Li Xuetao, Group CEO said, “We have made significant progress during the first half of the year, underlined by the improvement in our sales volume and unit margins. The ongoing global restocking drive post-pandemic and global logistic logjam have created windows of opportunity for the Group; our in-depth understanding of customer’s requirements and visibility of supply/demand dynamics, have allowed us to play a pivotal role in the natural rubber supply chain during this period.”

“In 2020, the outbreak of COVID-19 induced a widespread lockdown globally, which greatly reduced downstream demand levels. As a result, the financial performance of our key profit generators: HRC and CMCI’s have suffered. However, the situation has changed since H2 2020 with demand recovering strongly, which allowed HRC and CMCI to capitalise on the demand recovery to generate a much improved performance.”

“Our plantation assets in CMCP, despite currently contributing operating loss, are heading on the right direction – Yields are improving and operating costs are well-managed. Moving forward, the strengthening of latex prices and the improving demand will lay a pathway towards profitability in future, as the immature trees start producing and its yields are optimised.”

“I’m very proud with this performance as the entire team in Halcyon Agri has shown resilience and teamwork in navigating through this challenging period. I’m confident that we will get better.”

Stronger balance sheet to capture future opportunities

The Group’s funding initiatives in the last twelve months, most notably being the issuance of Sinochem²-guaranteed perpetual securities and the refinancing of US$300 million term loan, have placed the Group in a stronger financial footing and provided it with flexibility to capitalise on the buoyant demand for natural rubber.

The Group’s term debt to equity ratio currently stands at 0.72x on 30 June 2021, an improvement from 1.04x a year ago. The stronger balance sheet has also allowed the Group to enhance its financing terms with panel bankers. Where suitable opportunities arise, the Group will look into unlocking value of certain low-performing assets (which includes the non-core assets) in its portfolio through divestment.

Industry trends and outlook

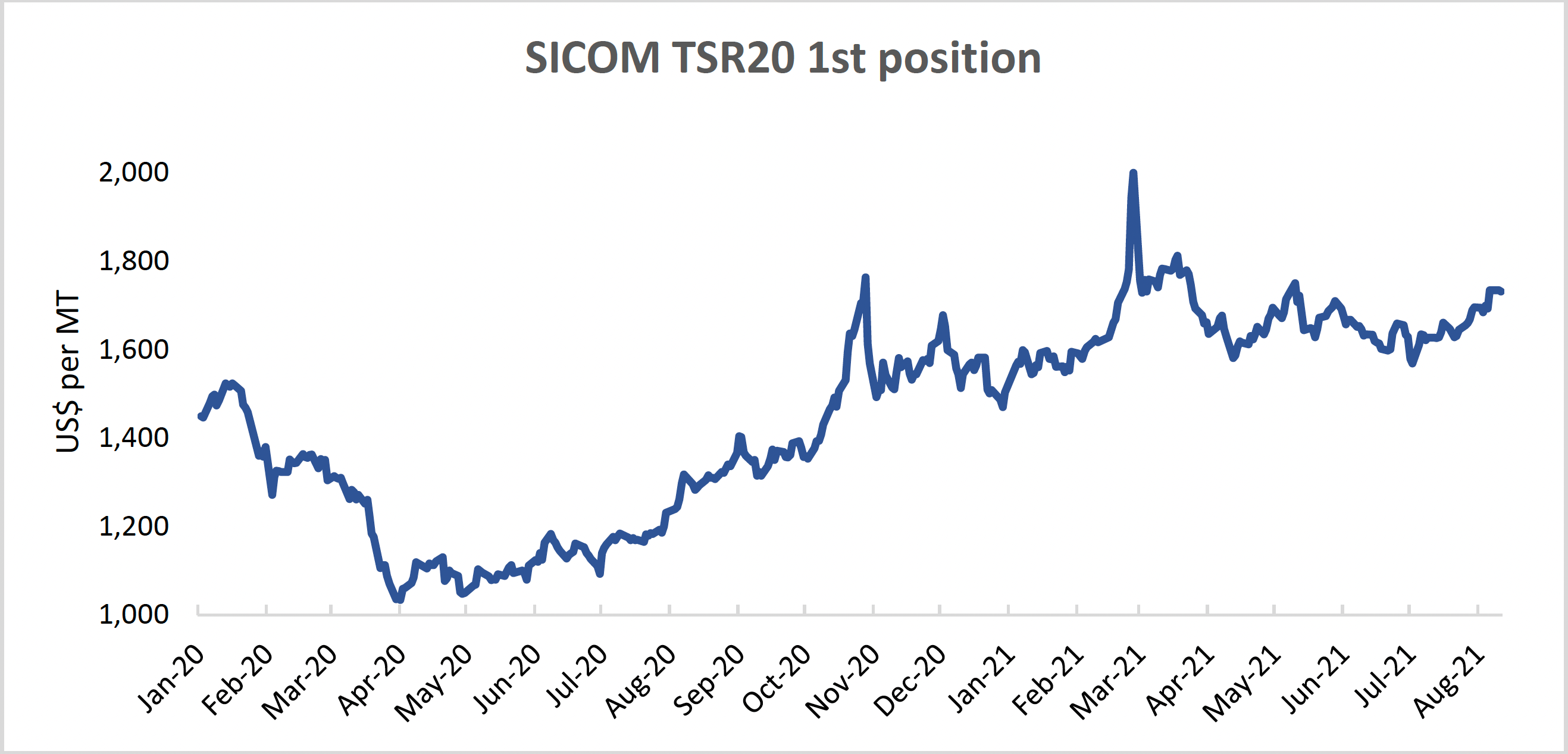

Natural rubber prices (indicated by SICOM TSR20 1st position) surged almost 30% since the start of 2021 to a four-year high of US$2,000 per mT in end-February 2021. Following a consolidation, price settled at US$1,696 per mT as of end July 2021.

Commenting on his views of the industry, Mr Li said, “The improvement in natural rubber prices was underpinned by robust demand post-lockdowns and supply shortage due to reduction of economic activities in major rubber producing countries to curb the recent surge in COVID-19 cases, caused by a much more contagious Delta variant.”

Global growth outlook remains upbeat. OECD raised its 2021 global growth forecast from 4.2% to 5.8% in May 2021 while IMF lifted its global growth outlook for 2022 for the second time, by 50 basis points to 4.9% in its July 2021 assessment (previous growth estimates were 4.2% in January 2021 and 4.4% in March 2021). These could be tailwind factors in boosting the natural rubber demand post-pandemic.

On the supply end, the prolonged low price environment in natural rubber has caused the upstream players, which are made up of predominantly smallholder farmers, to abandon the trade and switch to alternative cash crops or income source. This means that the supply that is coming online in the near future may not be sufficient to meet the surging demand, which will lead to supply-demand mismatch. Furthermore, the resurgence of COVID-19 cases has restricted population movement and disrupted operations in key origins, potentially aggravating the mismatch situation.

Mr Li further commented, “Despite the aforementioned factors, we are optimistic on the industry growth in the long run, as the long-term supply-demand dynamics remain intact – with factors such as positive economic outlook, increase in infrastructure spending and reopening of international borders, to underpin the long-term demand of this key natural resource. Nevertheless, the Group is also keeping a cautious stance over the effect of near-term uncertainties such as new strains of COVID-19, as well as any fiscal and monetary policies from the local governments in addressing the pandemic impact.”

Sustainability takes centre stage in industry agenda

The outbreak of COVID-19 has exposed one main vulnerability in the natural rubber industry: its high dependency on the millions of smallholder farmers in key origins. As the industry moves to address the sustainability of the upstream supply, the end customers have also grown increasingly conscious about their environmental footprint, which led to increasingly stringent product requirements – particularly in the areas of sustainability.

The Group is cognisant of the changing sentiment among its customers ahead of its peers, and has been investing our efforts extensively in this area, and our sustainability track record has been recognised by the industry: Ranked as the most transparent rubber producing company under SPOTT assessment³, and attained an EcoVadis Gold4.

As the leader in sustainability arena, Halcyon Agri is uniquely positioned to spur meaningful change for the betterment of the industry as a whole, while upholding the highest sustainability standards and focusing on initiatives to develop the local communities and to protect the environment. These will go a long way in enhancing our business in the future.

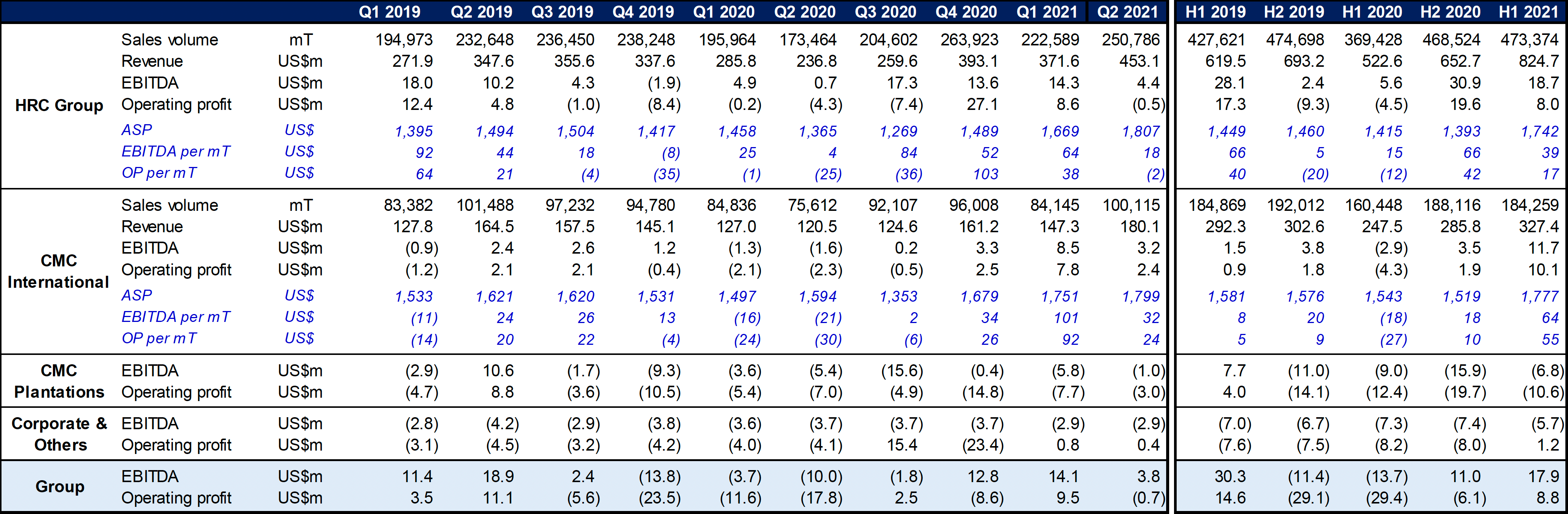

Key financial performance summary

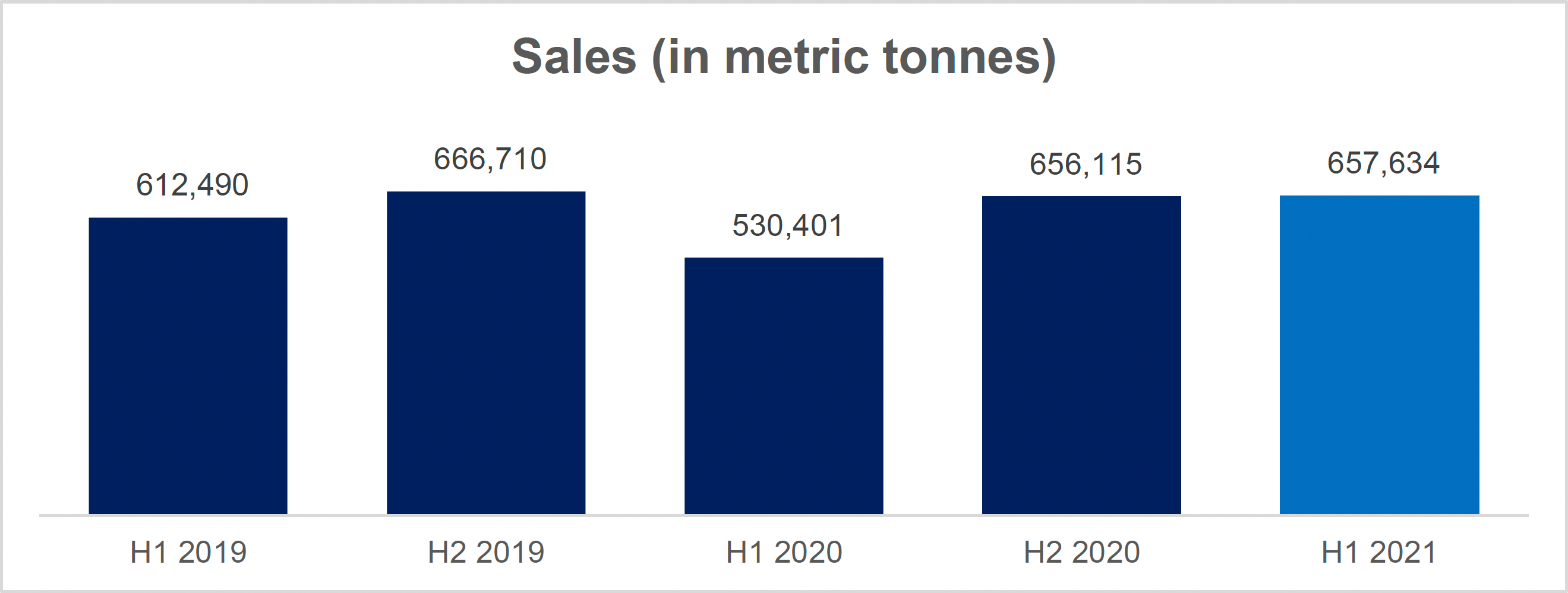

Sales volume hit pre-COVID levels in H1 2021 as the Group capitalised on improved demand in both the tyre and non-tyre sectors since H1 2020.

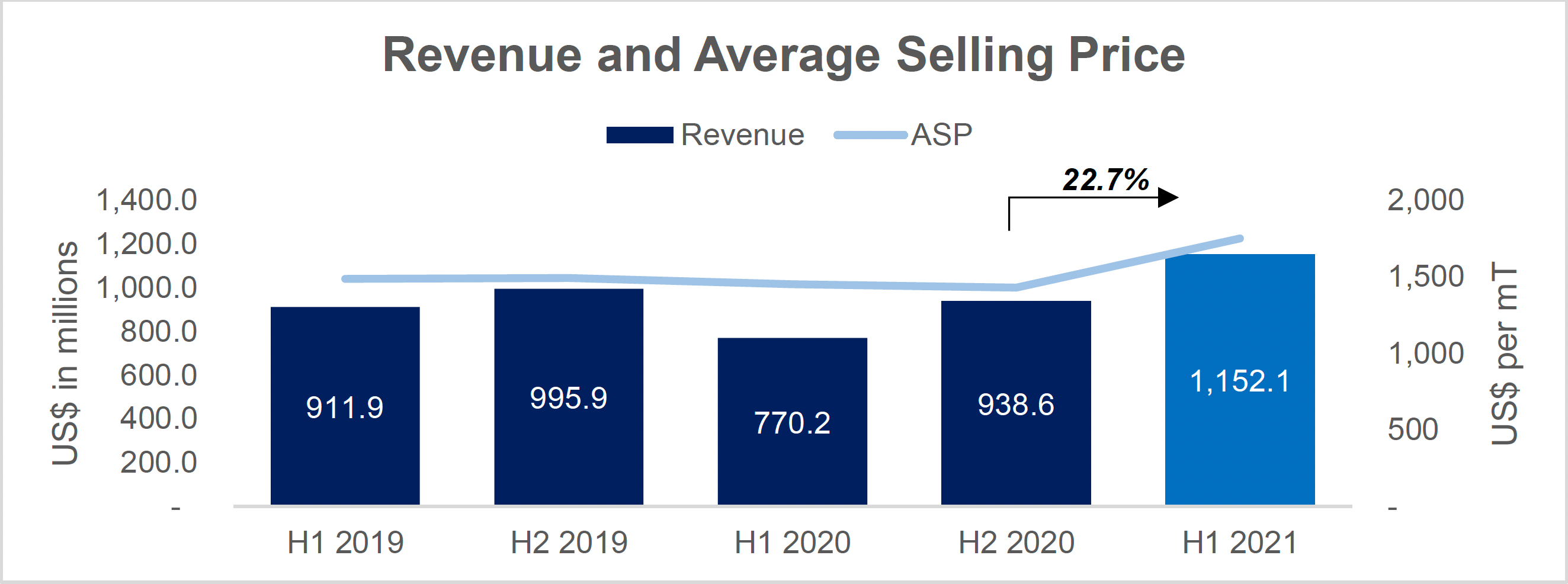

Buoyed by the movement in natural rubber prices, the Group achieved an average selling price (ASP) of US$1,752 per mT in H1 2021, a significant increase as compared to previous reporting periods. The Group’s revenue increased by 49.5% in H1 2021 from H1 2020, driven by the improved ASP and higher volume.

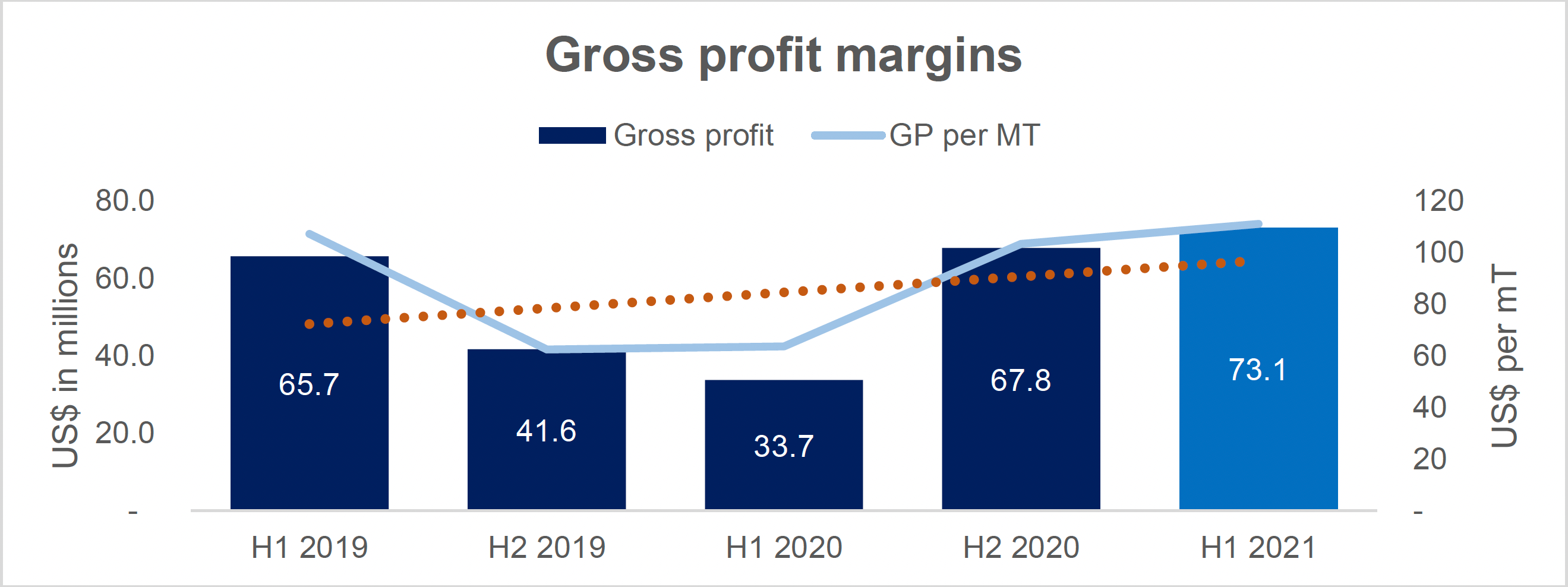

The Group’ H1 2021 gross profit more than doubled from H1 2020 and achieved two consecutive periods of expansion since H1 2020. This was mainly attributed to the increase in product sales volume and effective capturing of product margin.

The Group’s H1 2021 EBITDA improved 64.2% as compared to H2 2020, and recorded a positive turnaround versus H1 2020 driven by margin expansion for the Group’s rubber products, and narrowing of losses from gestating businesses due to conscious cost management.

Please refer Appendix for a summary of operating statistics.

###

About Halcyon Agri Halcyon Agri is a leading supply chain franchise of natural rubber with global presence. Headquartered in Singapore and listed on the Singapore Exchange (SGX: 5VJ), the Group owns and operates significant assets along the natural rubber value chain, and distributes a range of natural rubber grades, latex and specialised rubber for the tyre and non-tyre industries. It has 38 processing factories in most major rubber producing origins with production capacity of 1.6 million mT per annum, and is one of the largest owners of commercially operated rubber plantation globally. Halcyon Agri comprises two major business units:- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

————————————————————————————————————————————

Note: EBITDA, as defined herein, excludes fair value gains on biological assets and investment properties in respective periods.

¹ https://www.halcyonagri.com/en/press-release/sgx-invests-in-heveaconnect/

² Sinochem International Corporation, the major shareholder of Halcyon Agri

³ https://www.halcyonagri.com/en/press-release/halcyon-ranks-top-amongst-rubber-producers-in-spott-assessment/

4 https://www.halcyonagri.com/en/press-release/halcyon-agri-provides-corporate-updates/