Indonesian Natural Rubber Smallholder Economics

A comparison of smallholder income vs minimum wage in Indonesia.

By Gerald Tan, Vice President – Strategic Development, Halcyon Agri

90% of Indonesian natural rubber raw material is sourced through smallholders. The average smallholder in Indonesia owns 1.5 to 2 hectares of rubber trees. It is widely known that the rubber yields in Indonesia are notoriously low – let us take a closer look into the actual data from Gapkindo:

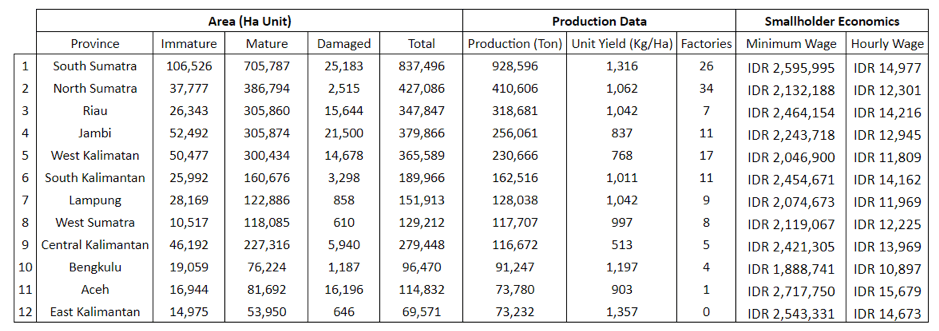

Table 1: Indonesian Rubber Plantations and Production Data from Gapkindo

From the table 1, we can see that the average yield of rubber is 1,022 kg per hectare per year. Minimum monthly and hourly wages of each province is included for easy reference.

At the point of writing, the prompt month of TSR20 traded on SGX hit a low of US$1,280 and as most factories sell to tyre customers based off the SGX futures price, I will be using it as a reference price for my next section on pricing and smallholder income.

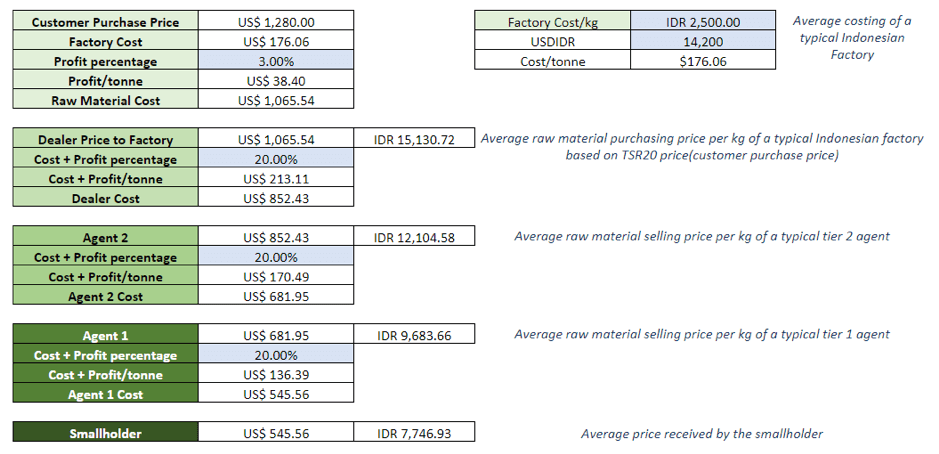

Table 2: Example of a Natural Rubber Supply Chain (Smallholder to Factory)

We can see from the prices at which the factory can sell to tyre manufacturer (customer) and the factory cost producing that rubber. I assume a measly 3% profit margin for the factory and I take the sales price less factory cost and profit margin giving the maximum raw material price that the factory can afford.

The typical supply chain in natural rubber ranges from 1 to 6 levels. In the above example, I have simplified it to just 3 levels, and at each level, I have assumed a discount of 20%, which is a realistic reflection of what happens on the field. Based on the above example, we can see the price that a smallholder will expect to receive for 1 tonne of rubber is about US$545.56.

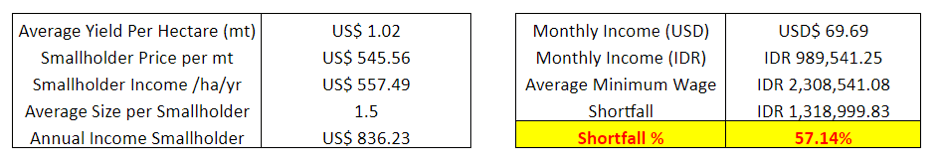

Table 3: Annual Yield and Income Projection:

Taking into consideration all the assumptions and data above, we can do a simple calculation of the annual income potential of the smallholder who has about 1.5 hectares of rubber. Converting the annual income to a monthly income and comparing it to the average minimum wage reveals that there is a shocking shortfall of 57.14%!

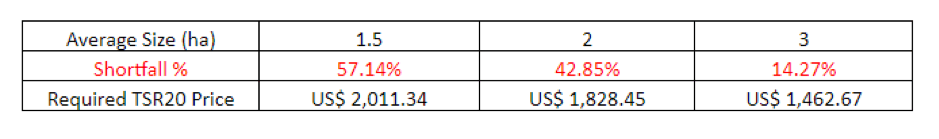

Some may argue that 1.5 hectare is too small, so I have included another example of a smallholder with double the size at 3 hectares in Table 4. You can clearly see there is still a shortfall of almost 15%!

Table 4: Shortfall vs Minimum Wage at Different Plantation Size

With the sustained depressed prices of natural rubber, it is no wonder that there is a drop in smallholder interest in rubber. Being an irreplaceable raw material crucial to many industrial products, this price is not sustainable. The current price discovery process where factories and consumers take reference off a futures market with little to absolute no regard to fundamentals is a broken one.

Many tyre manufacturers have started to issue policies about their raw material sourcing. These policies focus largely on rubber that is farmed on land that has free and prior consent, zero deforestation, no child labour and compliance with NGO’s guidelines. However, I do not see prices and the livelihoods of the smallholders being a factor in the policies.

Based on the calculations shown above, the purchase price of rubber currently is well below the minimum wage; can we call this a sustainable purchasing practice? The natural rubber supply chain pricing power lies largely with the customer, leaving the smallholders at their mercy as price takers. To exacerbate the situation, smallholders are also exposed to the whims and fancy of the extremely volatile futures market where swings of 100% over a course of a year is not uncommon. Can you imagine if your income fluctuated with that kind of volatility? I would politely suggest that the basic livelihoods of the smallholder, which will serve as a floor price, be included in the definition of sustainable sourcing.

Perhaps we should consider a new way to price rubber, a move towards industrial pricing where there is a cost plus approach and prices are set over longer periods. The aim is to give more stability to all stakeholders in the industry where everyone can benefit from the real value created by the smallholders rather than the focus on trading and speculation which is the state of the industry today.

______________________________________

Gerald Tan

Vice President – Strategic Development

Halcyon Agri