Halcyon Agri Reports H1 2022 Financial Performance

- Operating profit increased to US$26.6 million from US$8.8 million in H1 2021

- Deleveraging plan slated to unlock further value in H2 2022

SINGAPORE, 12 August 2022 – Halcyon Agri Corporation Limited (SGX: 5VJ) (“Halcyon Agri”, the “公司名称” and together with its subsidiaries, the “Group”), a leading natural rubber supply chain manager, today announced its financial performance for the half year ended 30 June 2022 (“H1 2022”).

The Group continued to demonstrate financial and operational resilience in H1 2022, despite global macro headwinds and volatile market conditions. The Group’s sales volume remains steady despite the strict lockdown measures imposed in China, which affected our deliveries to that region. This shortfall was recovered from better sales volume in the other regions, which bodes well with our ability as a global player in navigating through the challenging environment in H1 2022.

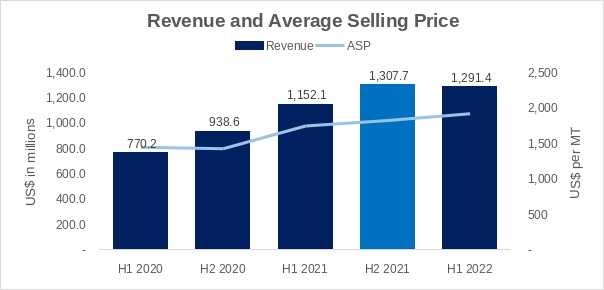

During the fiscal period, the Group’s revenue increased year-on-year (“Y-o-Y”) to US$1.3 billion in H1 2022, contributed by higher average selling price of US$1,922 against US$1,752 in H1 2021. Operating profit tripled from US$8.8 million in H1 2021 to US$26.6 million in H1 2022, reflecting the Group’s continuous efforts to capture margins and drive profitability.

Included within the H1 2022 operating profit are gains from disposal of non-core assets of US$10.3 million, which is part of the Group’s ongoing deleveraging initiatives. The Group’s net financing costs have increased by US$5.5 million Y-o-Y, driven by the effect of both higher interest rates and higher working capital loan utilisation. As a result, the Group registered a pre-tax profit of US$12.1 million and net profit of US$4.3 million in H1 2022.

CEO Remarks

Commenting on the Group’s H1 2022 performance, Mr Li Xuetao (李雪涛), Chief Executive Officer said, “Throughout H1 2022, the global economy has been affected by multiple factors ranging from geopolitical tensions, inflationary pressures, rising oil and gas prices, COVID-19 lockdowns in China to volatilities in equities and commodities markets. Despite these challenges, I believe we have done reasonably well – we displayed operational resilience and improved our overall profitability. At the same time, we continue to improve our working capital liquidity, to cater for the improving demand situation. Such initiatives include our deleveraging efforts, for which we disposed of certain non-core assets, and we have also completed a sustainability-linked facility of up to US$300 million during H1 2022.”

“All due credits go to Halcyon Agri team for making this happen. Also, I would like to thank all our stakeholders for their continued support. Looking ahead, while the macroeconomic environment might remain challenging for the rest of the year, we are focused on the execution of our strategies in delivering sustainable business performance. In navigating through these challenges, we will remain cautious and prudent in our approach to ensure we continue to extend our market leadership in the natural rubber industry, to rise above competition and emerge stronger than before. This paves the way to achieve sustainable profits.”

Financial Performance Summary

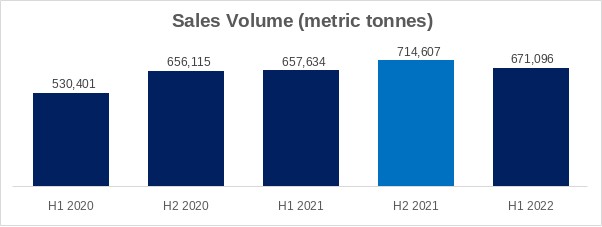

H1 2022 sales volume improved to 671,096 mT, maintaining momentum from past periods. Typically, deliveries are stronger in second half of each year.

H1 2022 revenue of US$1.3 billion represents an increase of 12.1% from US$1.2 billion in H1 2021. The Group’s revenue improvement aligns with the uptrend in its average selling prices of US$1,922 in H1 2022.

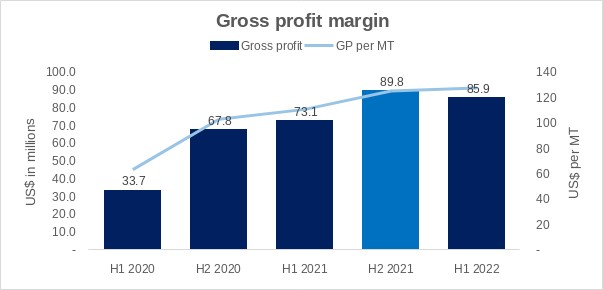

The Group reported a 17.6% increase in gross profit from US$73.1 million in H1 2021 to US$85.9 million in H1 2022. Gross profit per mT continues to grow despite at slower rate in H1 2022 under challenging market conditions as compared to H2 2021.

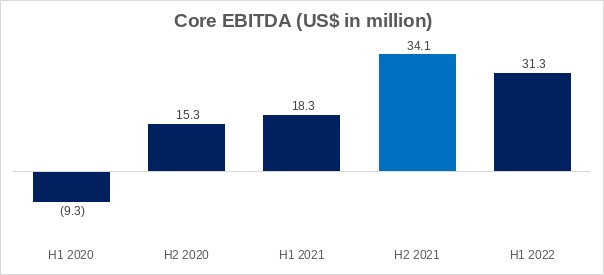

In tandem with its gross profit trajectory, the Group recorded EBITDA of US$31.3 million in H1 2022.

Please refer to the Appendix for the summary of operating statistics.

###

About Halcyon Agri

Halcyon Agri is a leading supply chain franchise of natural rubber with global presence. Headquartered in Singapore and listed on the Singapore Exchange (SGX: 5VJ), the Group owns and operates significant assets along the natural rubber value chain, and distributes a range of natural rubber grades, latex and specialised rubber for the tyre and non-tyre industries. It has 38 processing factories in most major rubber producing origins with production capacity of 1.6 million mT per annum, and is one of the largest owners of commercially operated rubber plantation globally.

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

电子邮箱:

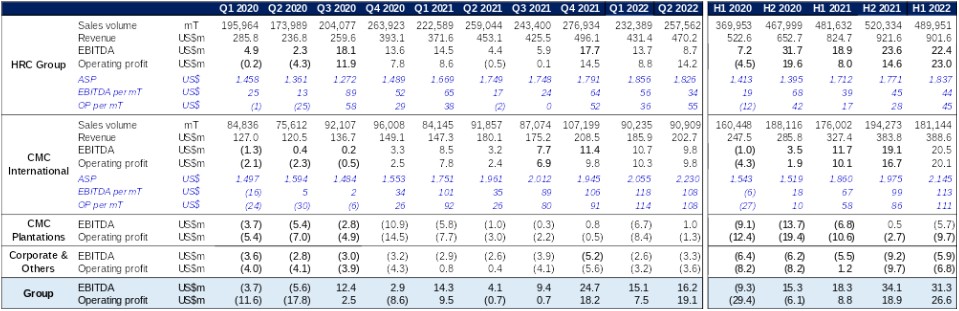

Appendix – Selected Operating Statistics Summary