Halcyon Agri Maintains Growth Momentum in Q3 2022

SINGAPORE, 21 November 2022 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) today provides voluntary business update for the third quarter ended 30 September 2022 (“Q3 2022”).

The Group maintains a stable overall performance in Q3 2022 despite the macroeconomic headwinds, as we continue to be prudent in operational and working capital management. Sales volume continued to grow, a testament to the strength of our global franchise. The recent decline in rubber prices has resulted in some level of margin compression in our plantation and processing businesses, but the effect was set off by a stronger performance of the distribution business in destination markets.

The Group continues to be profitable for the nine months ended 30 September 2022 (“9M 2022”).

Pre-Conditional Mandatory General Offer (“MGO”) by China Hainan Rubber Industry Group Co., Ltd. (“Hainan Rubber”)

With reference to our announcement on SGX dated 17 November 2022, Hainan Rubber has announced that it has entered into a share purchase agreement with Sinochem International (Overseas) Pte Ltd (“Sinochem”), to acquire 36.0% shareholding in the Company at US$0.315 (equivalent to approximately S$0.44 based on exchange rate of US$1.00:S$1.3839) per ordinary share. The share purchase will trigger a MGO. The share purchase and the MGO are subject to fulfilment of certain conditions precedent. Hainan Rubber, a state-owned company listed on the Shanghai Stock Exchange, is primarily engaged in the planting, processing and distribution of natural rubber in China and internationally.

CEO Remarks

Mr Li Xuetao (李雪涛), Chief Executive Officer commented, “The consummation of the share purchase and MGO will take time, considering the approvals required, and we will continue to provide timely updates to our shareholders as and when there are material developments. Halcyon Agri views this transaction positively, as it can further augment our position as the leading integrated supply chain manager. Meanwhile, the Group’s businesses will operate as usual as we remain focused to create long-term value for our stakeholders.”

“We have continued to achieve our operational goals despite the lower rubber prices environment and margin compression situation, which is reflected in our stable Q3 2022 results.”

“The recent interest rate increases by the Federal Reserve will inevitably affect global demand, but this could be offset by the resurgence of demand upon China’s reopening. We are confident that our business model and global presence have positioned us well to capitalise on the demand uptrend, enabling us to overcome any challenges ahead. The Group remains encouraged and cautiously optimistic on our prospects in the remaining months of FY2022.”

Financial Performance Summary

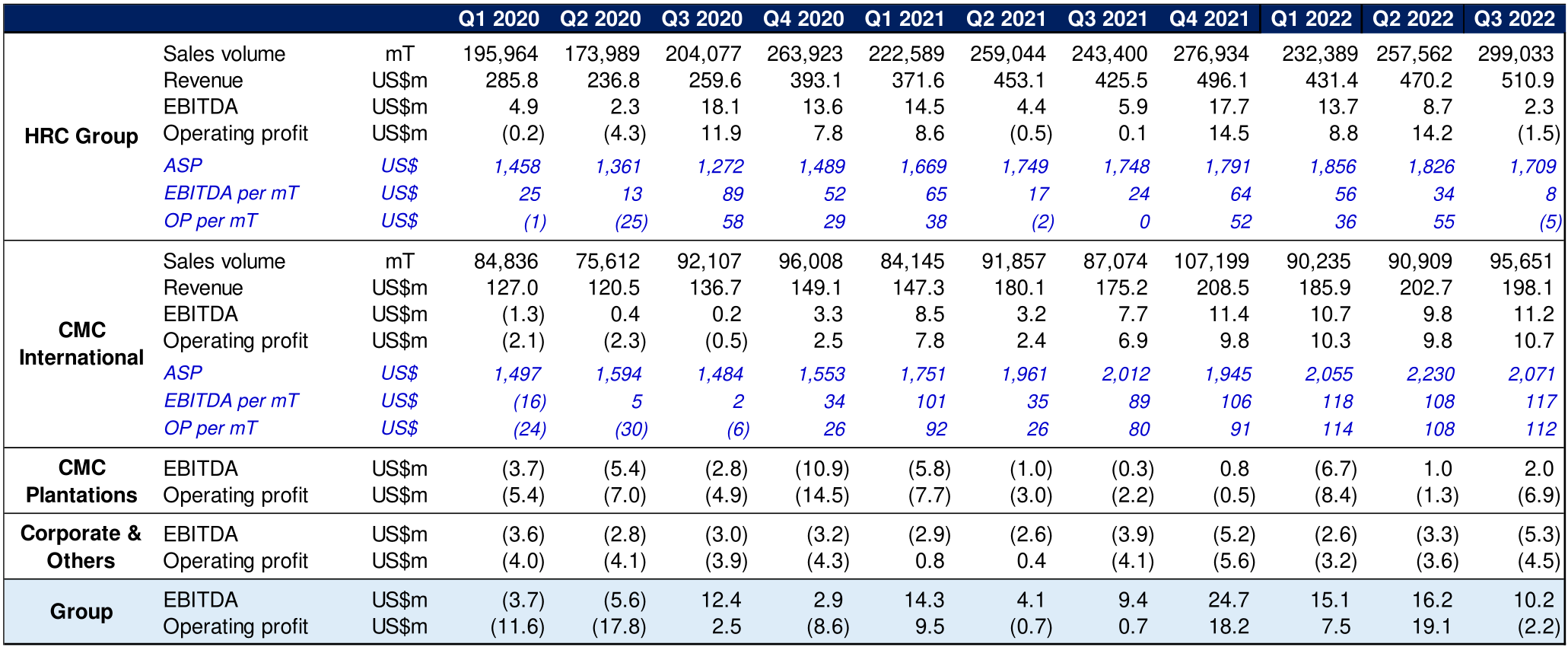

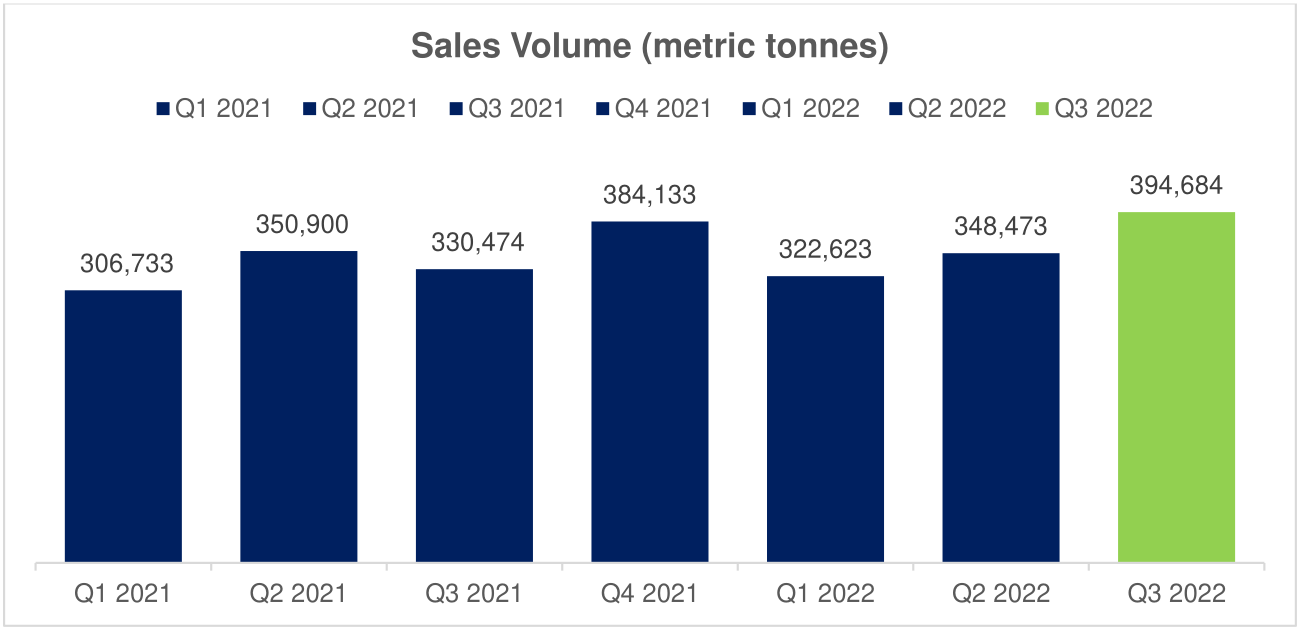

Q3 2022 sales volume grew to 394,684 mT from 330,474 mT in Q3 2021, attributed to the Group’s timely capture of market demand through its global pole position and vertically integrated capabilities.

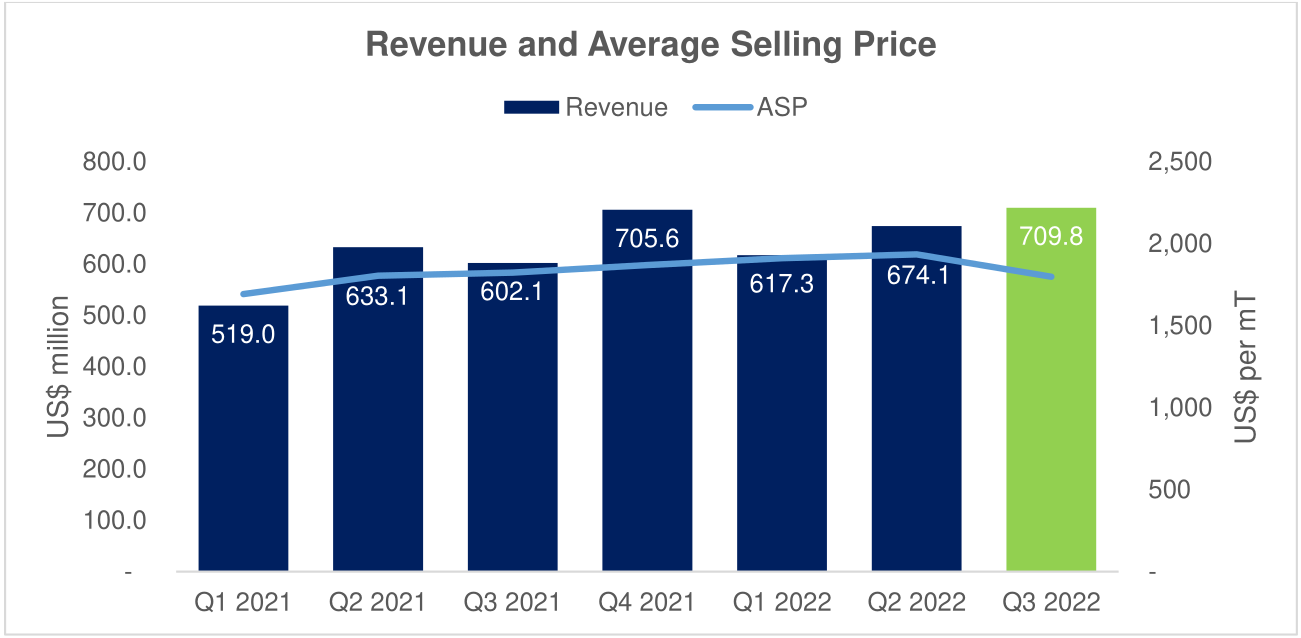

Q3 2022 revenue of US$709.8 million represents an increase of 17.9% from US$602.1 in Q3 2021. The Group’s average selling prices maintained its traction from past periods.

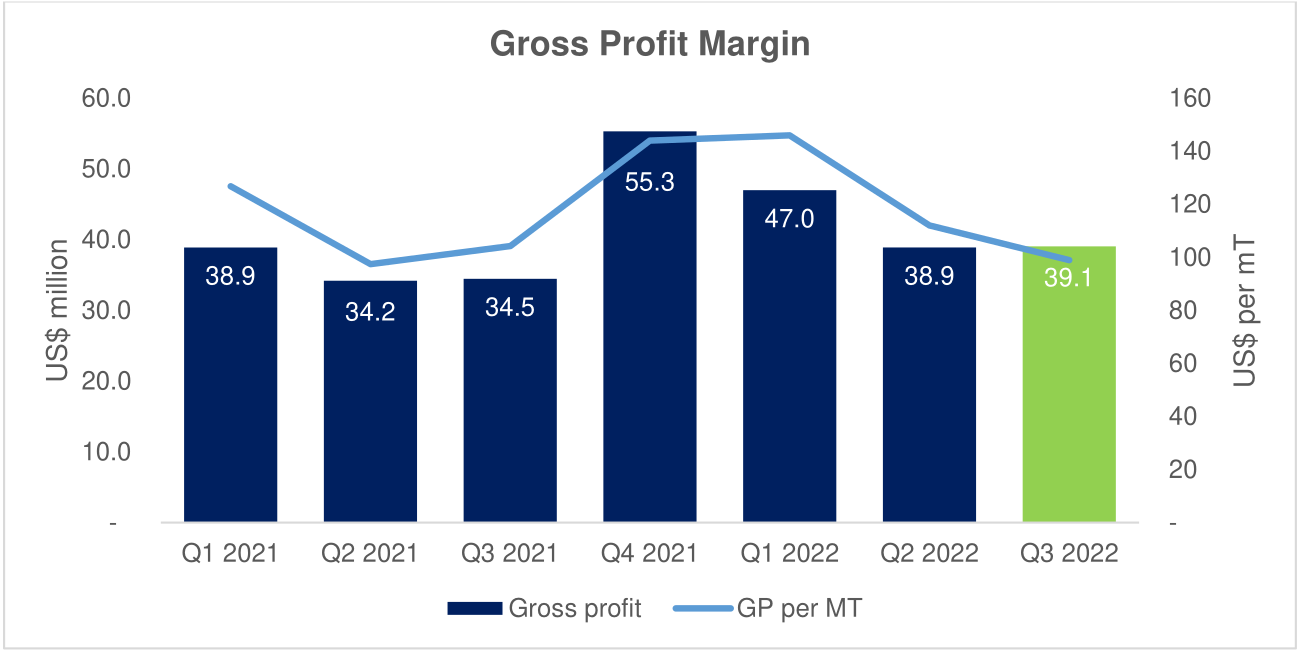

The Group reported 13.3% increase in gross profit to US$39.1 million in Q3 2022 from US$34.5 million in Q3 2021.

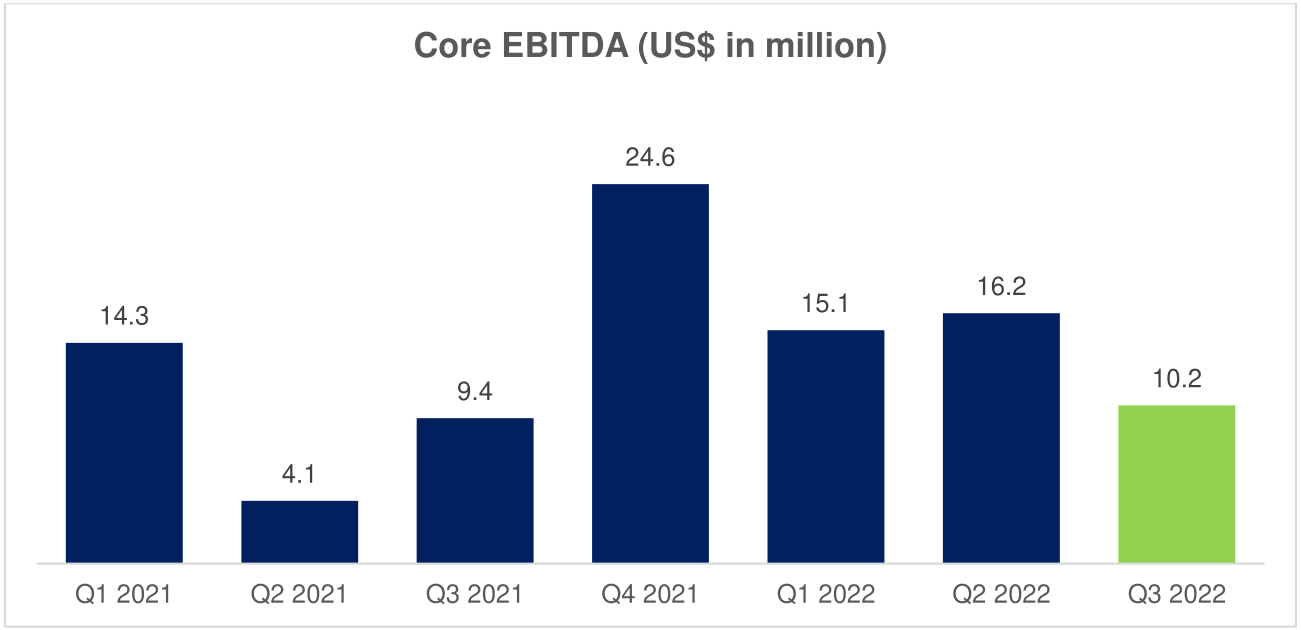

In tandem with gross profit improvement from Q3 2021, the Group recorded core EBITDA of US$10.2 million in Q3 2022.

Please refer to the Appendix for the summary of operating statistics.

###

About Halcyon Agri

Halcyon Agri is a leading supply chain franchise of natural rubber with global presence. Headquartered in Singapore and listed on the Singapore Exchange (SGX: 5VJ), the Group owns and operates significant assets along the natural rubber value chain, and distributes a range of natural rubber grades, latex and specialised rubber for the tyre and non-tyre industries. It has 38 processing factories in most major rubber producing origins with production capacity of 1.6 million mT per annum, and is one of the largest owners of commercially operated rubber plantation globally.

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

电子邮箱:

Appendix – Selected Operating Statistics Summary